Scroll down

Geostrategic competition is fragmenting the global financial system. The growing prominence of various national and crypto currencies has raised questions about whether the dominance of the US dollar (USD) in that system will decline in the coming years. The dollar’s status has provided the US and the West more broadly with major advantages, such as control over global financial assets and the ability to implement sanctions. This in turn has deterred many countries from pursuing assertive and military actions.

It has become clear that the US dollar will face challenges to its dominant status in the coming years.

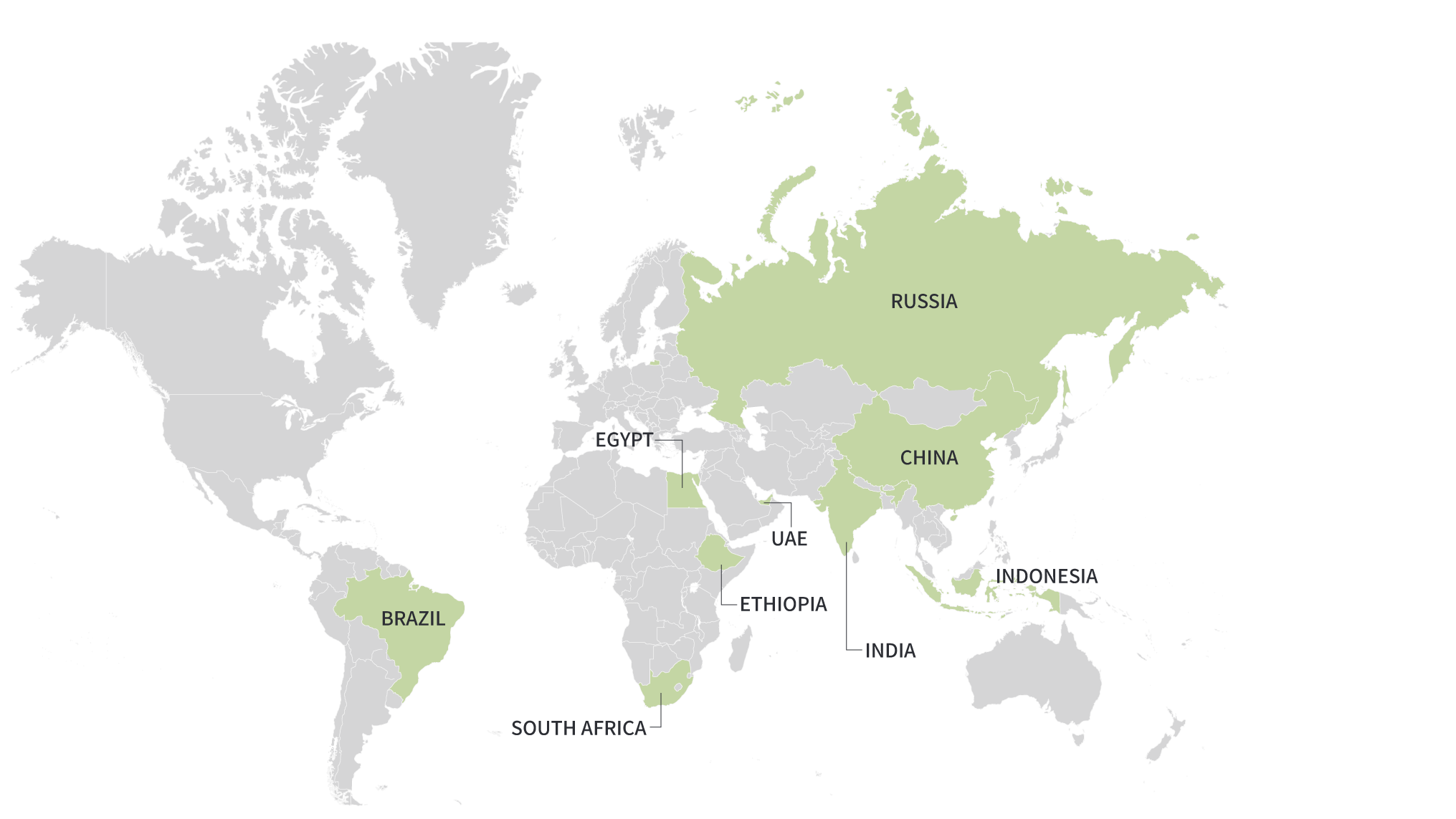

The trend of dedollarisation in recent years has been divided alongside geographical fault lines. BRICS countries have led the way in diversifying their reserves and adopting alternative payment systems.

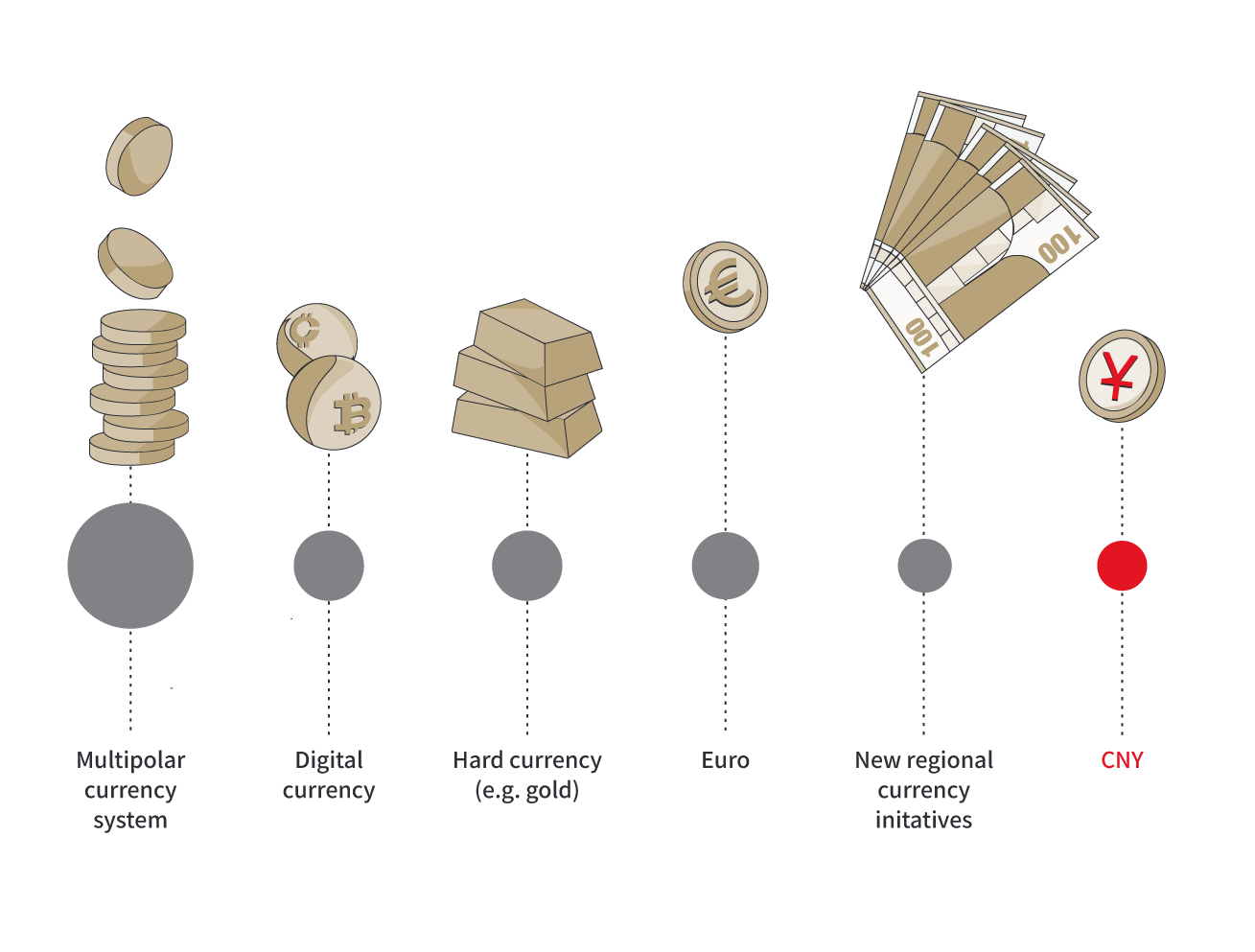

There are various alternatives to the dollar-dominant system.

This includes adopting a multipolar currency system, as well as using the Chinese yuan (CNY).

It has also signed currency swap agreements with more than 40 countries, enabling them to trade directly in yuan. While the volume of trade in yuan is still small, the financial infrastructure that is being put in place is creating the potential for this trend to accelerate quickly in the future.

China is also building an alternative financial architecture that could fasten the adoption of the yuan.

In the past few years, Beijing has sought to promote its Cross-Border Interbank Payments System (CIPS) as an alternative to a dollar-denominated payment system used by most financial institutions.

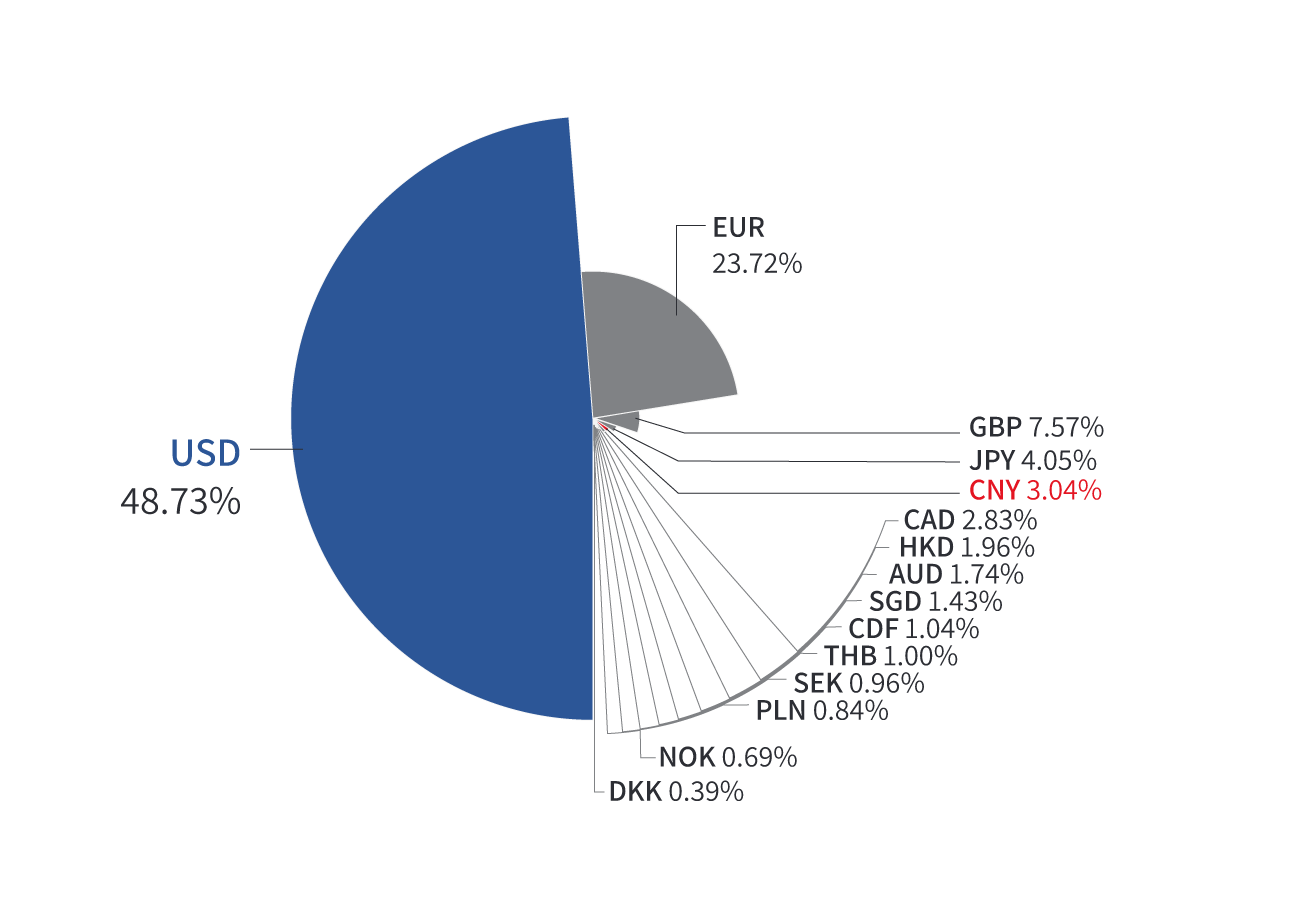

The CNY in particular is often described by financial commentators as one of the main rivals to the dollar, given China’s geopolitical competition with the US.

Still, there has been a notable trend in an increase in yuan invoicing, especially after the US and Western countries imposed sanctions on Russia over its invasion of Ukraine in 2022.

Use of the Chinese yuan is currently nowhere near that of the USD.

(October 2024)

Rising demand for gold is also challenging the dollar’s dominance. This is evident in data by central banks globally that have been acquiring gold at a heightened pace over the past few years.

The trend is particularly pronounced among BRICS countries, which has not only suggested launching its own gold-backed currency, but its members are among the countries to have also added most gold to their reserves over the past decade.

Global financial fragmentation could weaken Western nations' ability to impose sanctions in the coming years.

Western countries' dominance over the global financial system has enabled them to put economic pressure on adversaries. But a new financial structure would make it easier for adversaries to avoid the full impact of Western sanctions, weakening them as a geopolitical tool.

An integrated financial alliance among these three nations could also enable them to boost their cyber operations as well as covert activities, especially for Iran in countries globally.

North Korea would probably use better access to foreign finance to fund its military and prop its regime. This, in turn, would allow it to further develop its weapons systems. Pyongyang taking assertive actions against South Korea would raise conflict risks around the Peninsula.

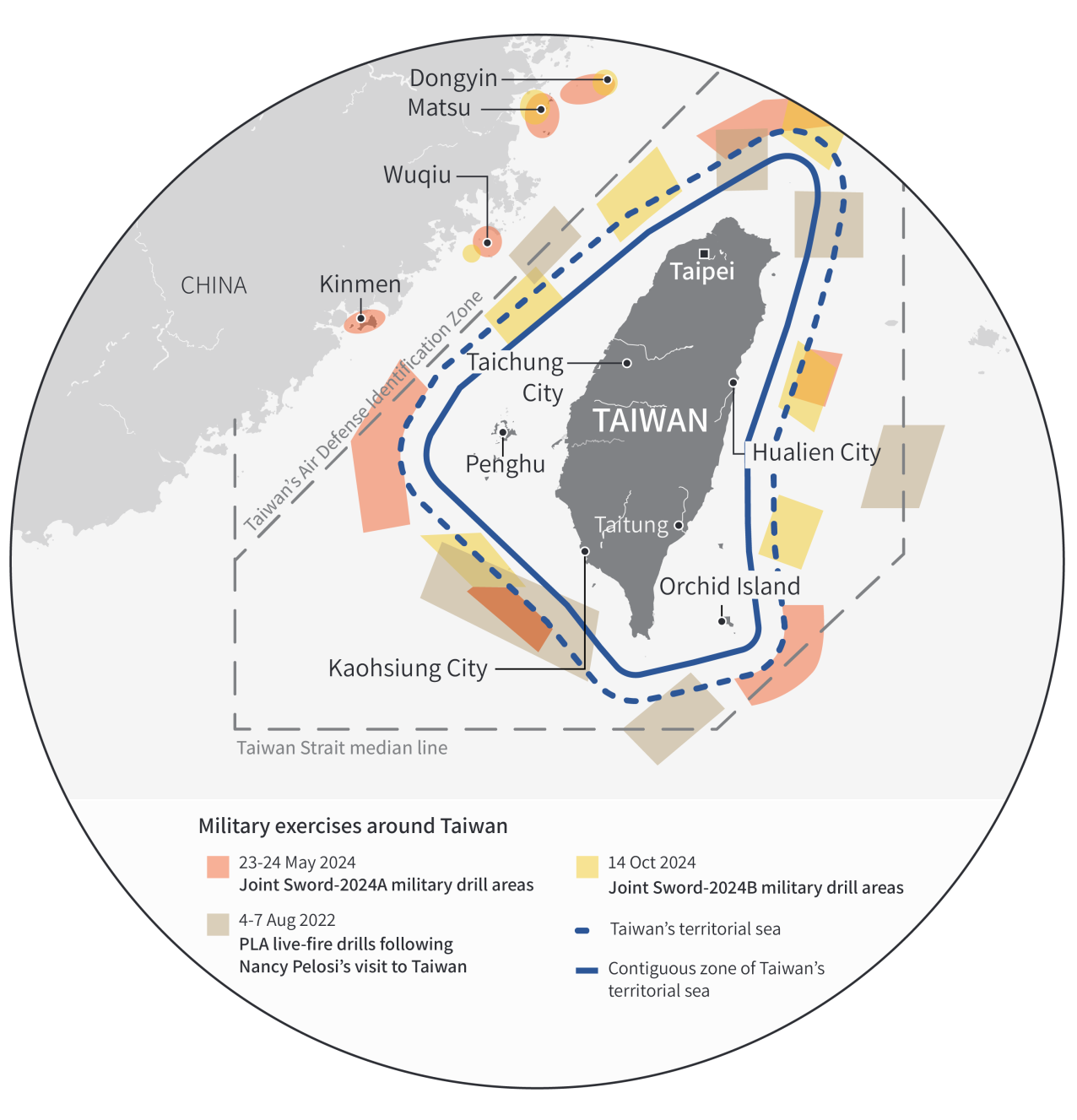

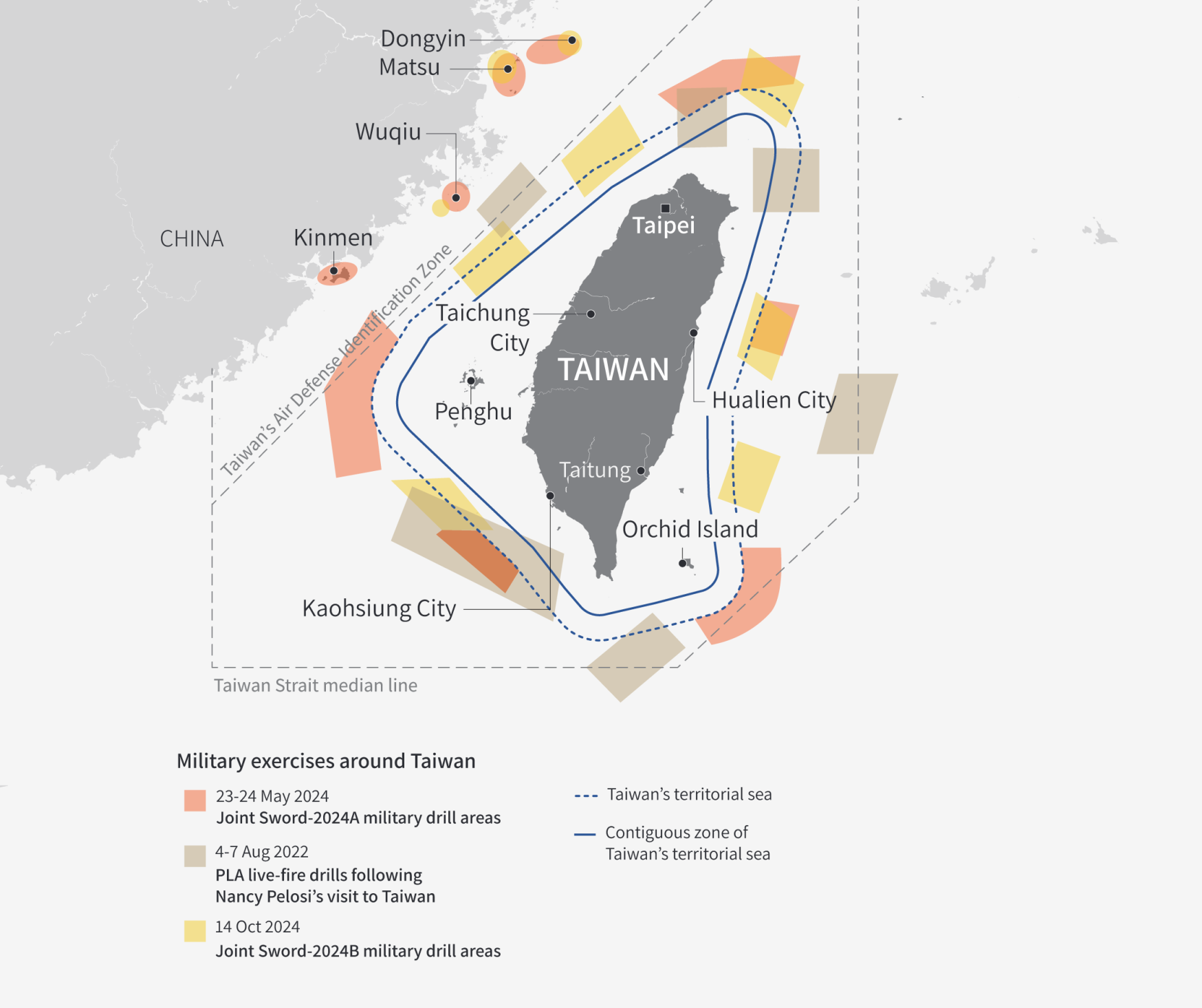

The ability to circumvent sanctions could embolden some countries to take assertive steps in the future. Countries that Western countries have long sought to keep in check include: China (territorial claims in the Taiwan Strait), Iran (nuclear weapons programme), North Korea (nuclear weapons development and ballistic missile tests), and Russia (territorial ambitions in Europe).

For Iran specifically, the ability to circumvent Western sanctions would not only free it from the main constraints to developing its nuclear programme but also further encourage it to boost the capability of the Houthis to mount attacks in the Red Sea. In addition, the reduced effectiveness of sanctions would also leave Western countries with few options to stop the nuclear programme but military action.

© 2025 Dragonfly Eye Limited

Images: Adobe Stock Video: Stacks of Coins with a World Map Background Representing Global Finance Trends, Video by Atchariya63, Getty Images: (David Gray / Contributor, Fabrice Coffrini / Contributor), Public Domain: Image courtesy of the Executive Office of the President of the United States

Sources: SWIFT RMB Tracker, The World Gold Council, CFA Institute Research and Policy Center

For more on how to prepare for a potential crisis in an increasingly multipolar world, see our Strategic Outlook 2025.