CARIBBEAN

CONSISTENT

WORSENING

IMPROVING

Overall trend: Worsening

Image: Andressa Anholete/Getty Images

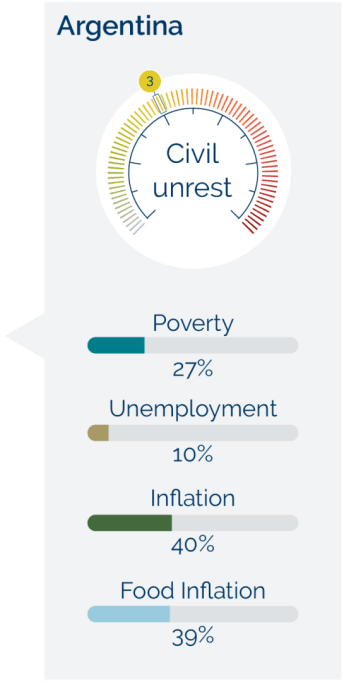

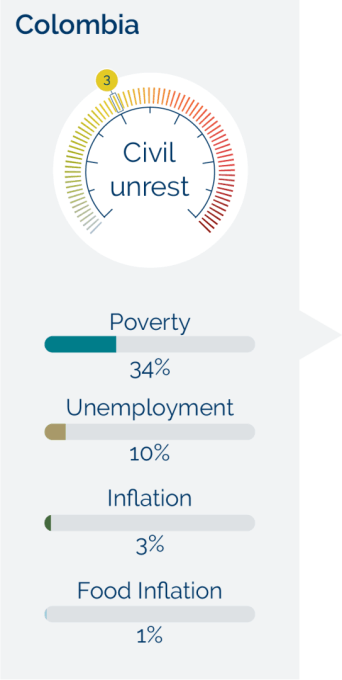

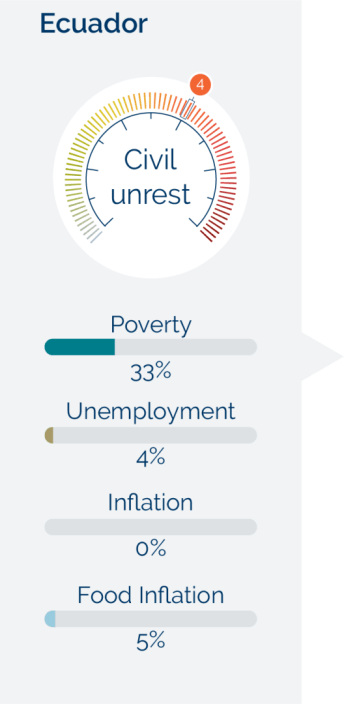

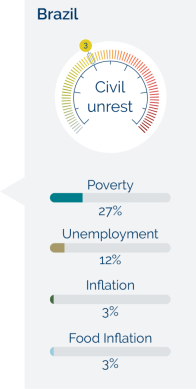

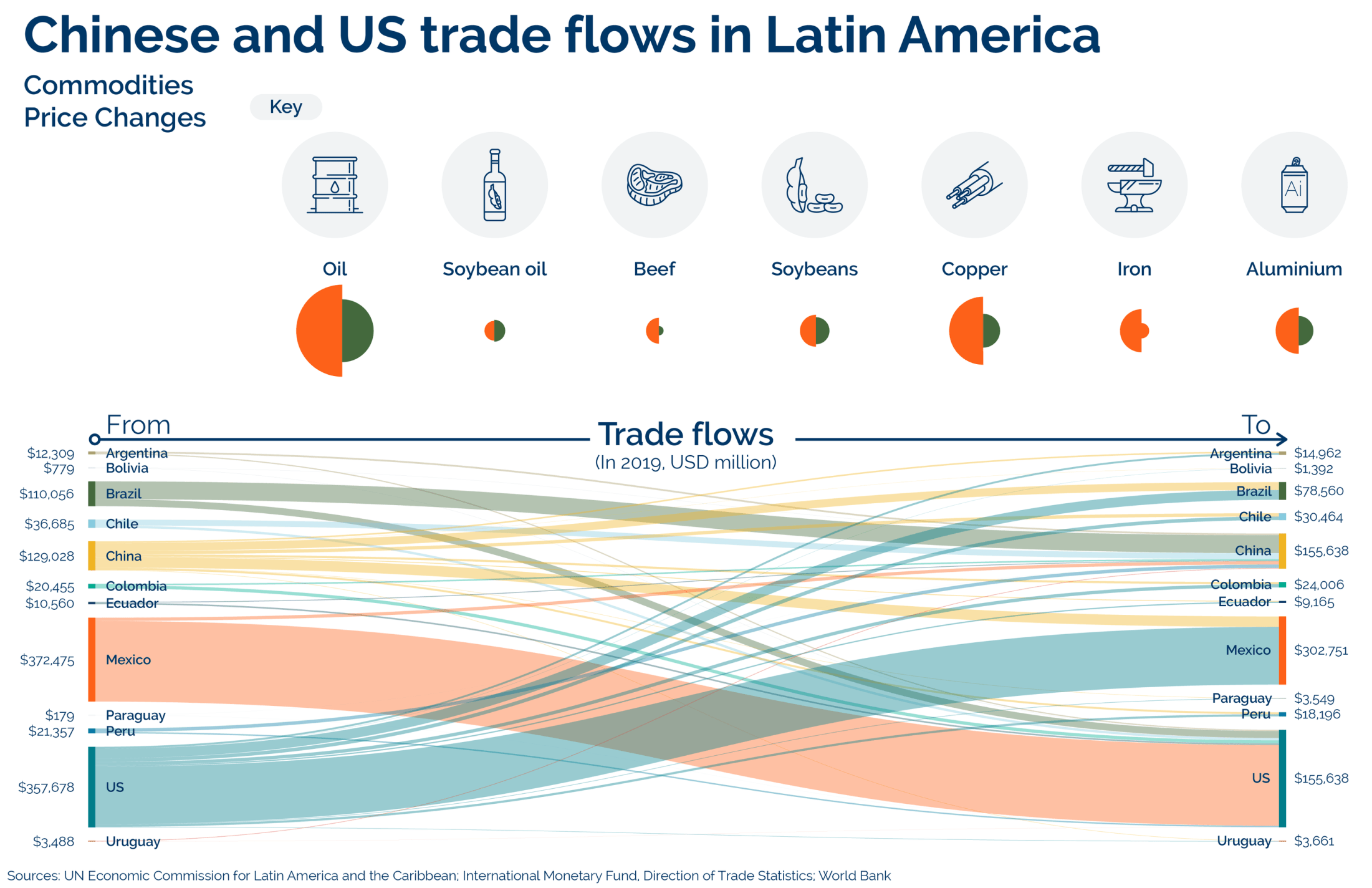

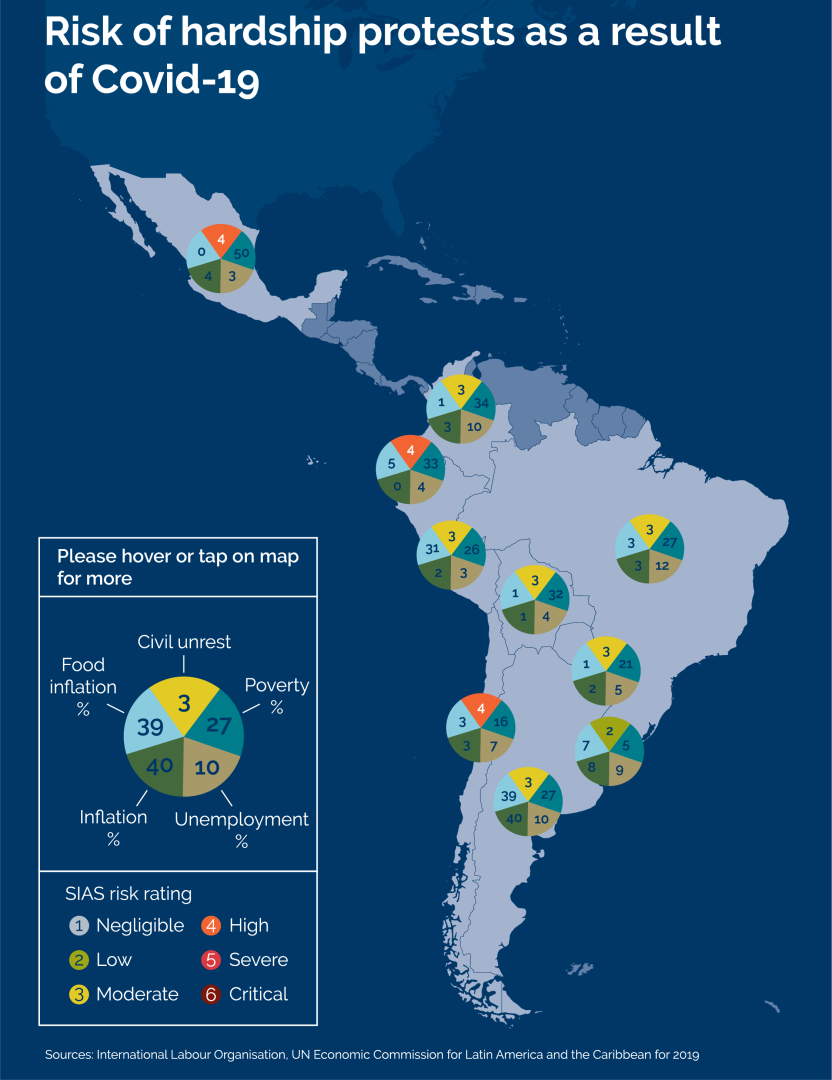

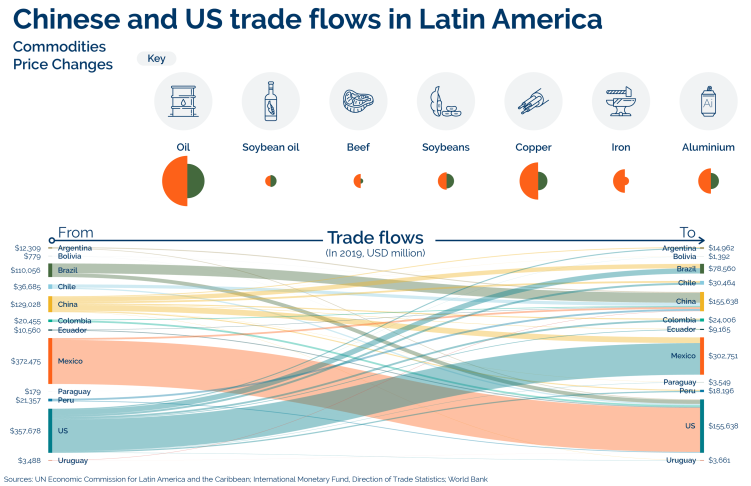

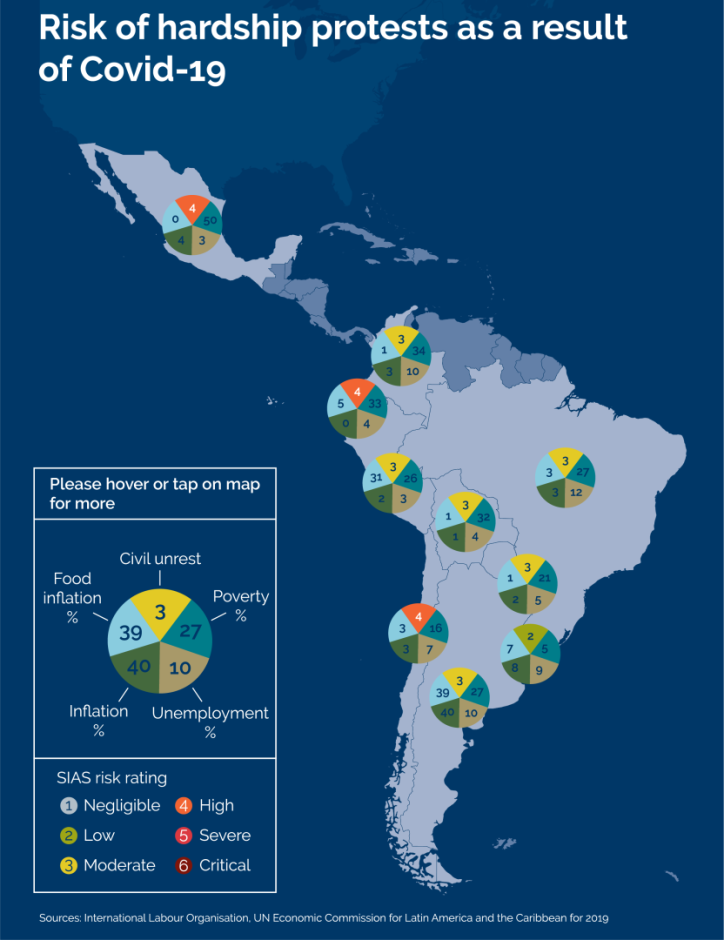

Political instability and governance standards are likely to worsen across much of Latin America in 2021. The Covid-19 pandemic has pushed many countries into deep recessions and this will probably exacerbate operational risks such as protests and social unrest. As most will struggle to rebuild their economies, they are very likely to rely on direct external support, particularly from China and the US. While this will help governments curb instability, it is also likely to influence domestic politics across the region.

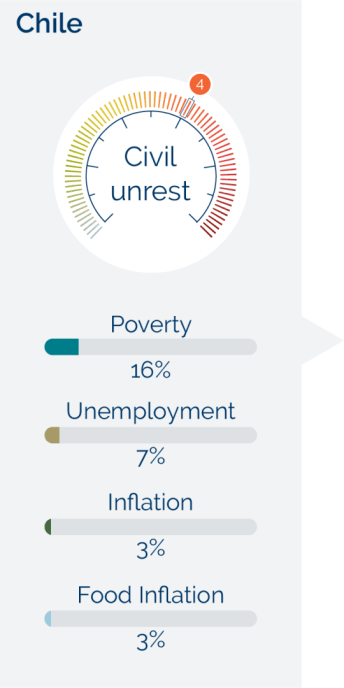

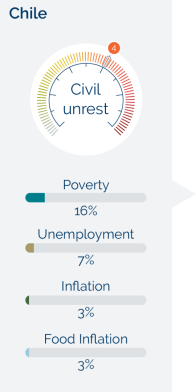

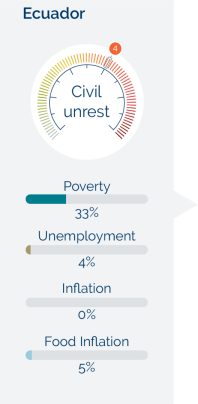

We forecast that most countries will struggle to mitigate the challenges laid bare by the Covid-19 pandemic. Underfunded health systems across the region have been pushed to their limits, and governments have struggled to address economic hardship. Ecuador and Chile seem particularly vulnerable to destabilising political crises, but there is little prospect of any country in the region reversing the economic damage of the pandemic this year.

The governments in Ecuador and Chile will find it hard to stabilise the operating environment for businesses in the short term. Deep-seated inequality and other socio-economic and political grievances will make it easy for anti-government activists, particularly from the far-left, to mobilise beyond their core support group. Political demonstrations are likely to escalate with little warning into short and localised bouts of unrest, based on precedent in both countries. This is also likely to increase the exposure of businesses with direct or perceived links with the state to unrest-related vandalism.

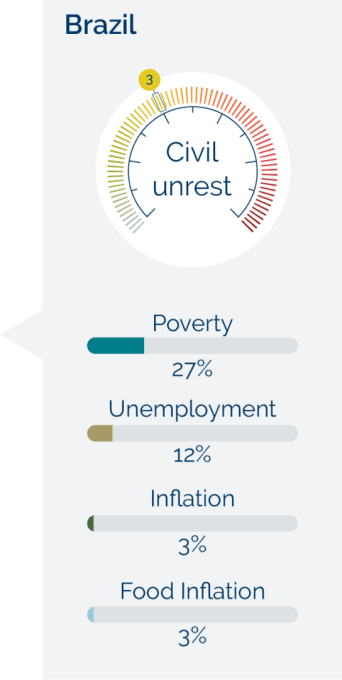

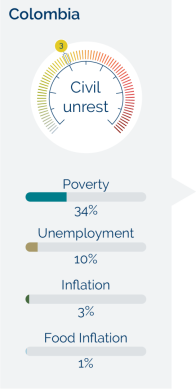

There will probably be no successful regional efforts to address these economic or public health issues collaboratively. Argentina, Brazil and Colombia would be central to any regionwide responses, but ideological differences between these governments are likely to impede cooperation. Such polarisation in the past decade has divided the region on issues such as trade, migration and environmental protection. Despite the magnitude of the Covid-19 crisis, we have seen few signs that political leaders are likely to seek to bridge existing schisms.

Argentina, Bolivia, Colombia and Peru seem most likely to reach out for foreign support. But we forecast that China and the US will try to draw as many Latin American countries as possible into their sphere of influence. They are likely to do this mainly by providing material aid, loans or promoting private investments. While this will help these governments limit the potential for large protests and social unrest, we anticipate it will come with pressure for the recipient government to support their backer’s foreign policy objectives.

The need to pick sides between China and the US will almost certainly further polarise the region. For those seeking Chinese backing, a severing of diplomatic ties with Taiwan is likely to be the main demand. Meanwhile the US will probably use its clout to strengthen a regional coalition of countries pushing for regime change in Venezuela.

We forecast that several countries in the region, particularly Brazil and Colombia, will join the US

in pushing for a peaceful transition to democracy in Venezuela. Their main tactic will probably be a broadening of sanctions, while offering a much-needed economic rescue plan in exchange for President Maduro’s resignation. We anticipate

that they will succeed towards the end of the year

in persuading at least some senior members of the Venezuelan government to drop their support

for Maduro and commit to fair or free elections

in 2022.

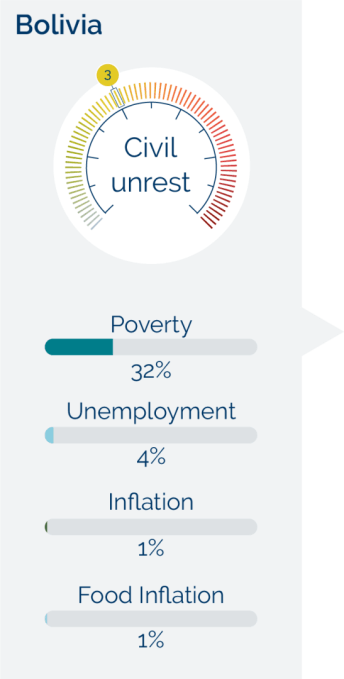

Competition for influence in Bolivia is also likely to preoccupy China and the US in 2021. We see this being positive for security and stability in Bolivia. The government there is likely to continue its cautious stance towards the US. This is particularly as the governing MAS party claims the US helped to force former president Evo Morales from office in late 2019. But Bolivia is in a strong position to balance relations with China and the US. The economic benefits of this will help the country avoid a resurgence of large anti-government protests.

Foreign economic aid is likely to help the government in Argentina avoid facing destabilising protests and strikes. Though anti-government demonstrations in major cities will almost

certainly remain common next year. President Alberto Fernandez’s efforts to pass judicial reforms are a probable trigger for protests. But the government will probably be able to assemble sufficient aid to avoid unpopular cuts to welfare, wages and subsidies. And this will safeguard his strong bond with the country’s main trade unions and ensure that any protests do not cause government instability.

Operational risks to businesses in Brazil will probably include having to often adapt to changing government policies in 2021. President Jair Bolsonaro’s often erratic approach to foreign relations means that he is likely to struggle to balance relations with China and the US. Brazil and China have long had close economic ties, while Mr Bolsonaro is ideologically more drawn to the US. But plans by the Biden administration to push for environmental protection of the Amazon rainforest means that Mr Bolsonaro will probably seek to sustain and deepen economic relations with China.

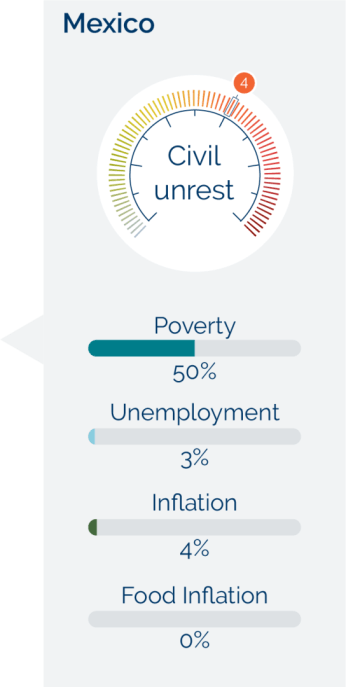

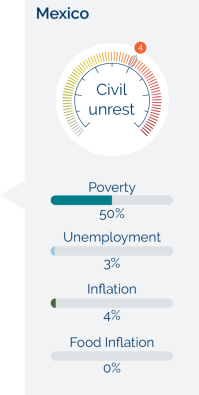

An unstable security environment in Mexico means that the government will probably have to relent to US pressures on its counter-narcotics approach before being able to fully access its economic aid. The government is very likely to maintain close ties with the US, its main trading partner. But organised crime and persistently high gang-related violence mean that it is likely to give in to US calls for a more robust approach against organised crime groups.

The Biden administration is likely to make its assistance, at least partially, contingent on Mexico increasing the military’s role and accepting more US security assistance in its fight against organised crime groups. While this indicates that external influence will probably help to mitigate some risks, they are unlikely to resolve all operational risks in Mexico or the region at large. And this means that political instability is likely to persist across Latin America this year.

An unstable security environment in Mexico means that the government will probably have to relent to US pressures on its counter-narcotics approach before being able to fully access its economic aid.

Image: Javier Torres/Getty Images

Image: Carolina Cabral/Getty Images

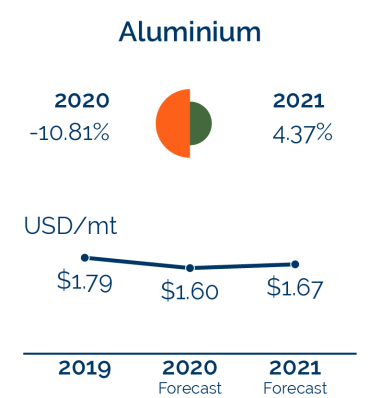

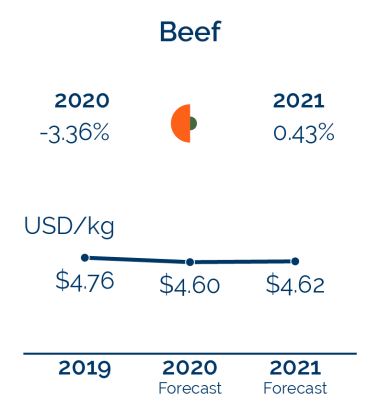

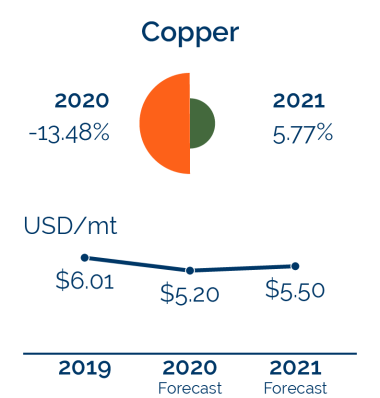

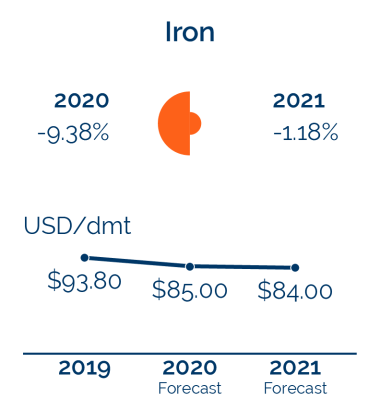

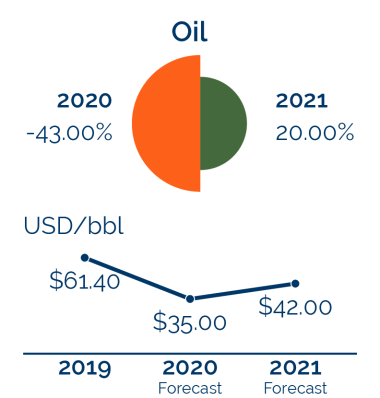

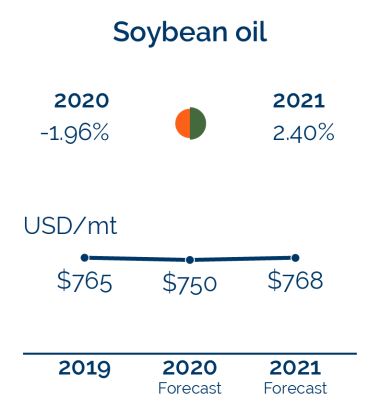

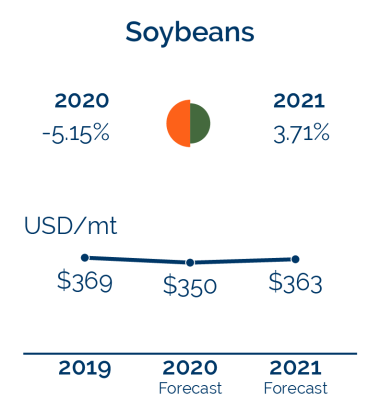

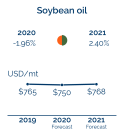

Tap or hover over each

commodity to see more

Forecasts

The ELN will probably relent to government pressure and fulfil all preconditions for peace talks towards the end of 2021. But these will probably drag on for a few years, based on previous negotiations with the FARC. Factions within the ELN will probably resist the process and mount frequent attacks against security forces.

Peace talks in Colombia

Under US pressure, the Mexican government will probably continue its military-led approach against organised crime groups, with frequent military operations against gangs in the most affected states near the US border. A state of emergency declaration in these areas and increased security operations are likely to cause significant disruption to businesses operations.

Counter-insurgency in Mexico

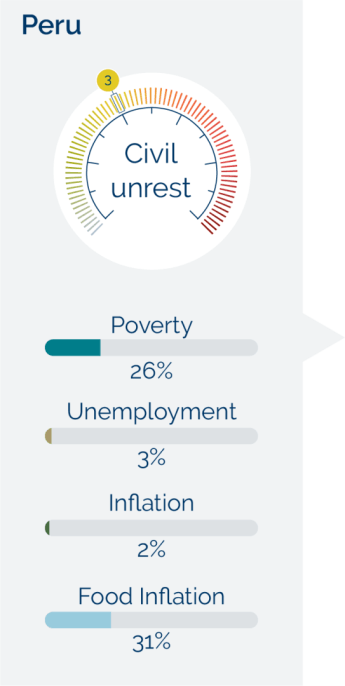

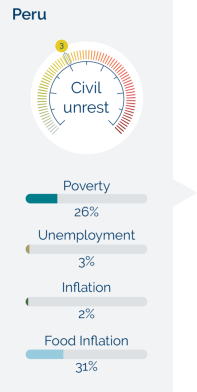

Renewed tensions between congress and the presidency after a general election in April are likely to lead to institutional deadlock and protests by supporters of former president Vizcarra. Political parties that led the impeachment of Mr Vizcarra in November 2020 will probably fail to secure a majority in congress and win the presidency. Protests by supporters of Mr Vizcarra will gradually subside in the weeks after the poll, but short bouts of disruptive protests remain likely in 2021.

Political paralysis in Peru

Forecasts

Outliers

Morales returns to cabinet in Bolivia

Monitoring Points

China supporting Maduro

Greater Chinese financial support for Venezuela will be an indicator for greater resilience and stability of President Maduro’s regime in the face of regional efforts to unseat him. The most likely route for China to support Mr Maduro is through investments by Chinese firms into the country’s oil infrastructure or joint ventures with local companies.

Covid-19 response

The responses of regional governments to domestic Covid-19 outbreaks will be determined by the availability and potency of vaccines. Most countries in Latin America will probably gain access to vaccines soon after they are officially approved and mainly through Covax, a global mechanism to ensure low-income countries have access to Covid-19 vaccines. A serum by US company Pfizer will probably be the first to be rolled out in Q1. But full inoculation will depend on the completion and roll-out of other vaccines by Chinese, Russian and UK firms later in the year.

Brazil-US relations

The effectiveness of regional intergovernmental organisations this year will greatly depend on relations between the presidents of Brazil and the US. Mr Bolsonaro and Mr Biden are very likely to clash over environmental protection in the region, which will probably block regional cooperation on other issues as well. Two scheduled meetings of the Organisation of American States (OAS) are likely flashpoints for spats; the General Assembly in Guatemala, probably in June 2021, and the Summits of the Americas in the US, probably around mid-to-late 2021.

Images: Javier Mamani; Luis Acosta; Alexis Delelisi; Pool; Nelson Almeida; Carlos Mamani/Getty Images

CARIBBEAN

Overall trend: Worsening

CONSISTENT

WORSENING

IMPROVING

Image: Andressa Anholete/Getty Images

Political instability and governance standards are likely to worsen across much of Latin America in 2021. The Covid-19 pandemic has pushed many countries into deep recessions and this will probably exacerbate operational risks such as protests and social unrest. As most will struggle to rebuild their economies, they are very likely to rely on direct external support, particularly from China and the US. While this will help governments curb instability, it is also likely to influence domestic politics across the region.

We forecast that most countries will struggle to mitigate the challenges laid bare by the Covid-19 pandemic. Underfunded health systems across the region have been pushed to their limits, and governments have struggled to address economic hardship. Ecuador and Chile seem particularly vulnerable to destabilising political crises, but there is little prospect of any country in the region reversing the economic damage of the pandemic

this year.

The governments in Ecuador and Chile will find it hard to stabilise the operating environment for businesses in the short term. Deep-seated inequality and other socio-economic and political grievances will make it easy for anti-government activists, particularly from the far-left, to mobilise beyond their core support group. Political demonstrations are likely to escalate with little warning into short and localised bouts of unrest, based on precedent in both countries. This is also likely to increase the exposure of businesses with direct or perceived links with the state to unrest-related vandalism.

There will probably be no successful regional efforts to address these economic or public health issues collaboratively. Argentina, Brazil and Colombia would be central to any regionwide responses, but ideological differences between these governments are likely to impede cooperation. Such polarisation in the past decade has divided the region on issues such as trade, migration and environmental protection. Despite the magnitude of the Covid-19 crisis, we have seen few signs that political leaders are likely to seek to bridge existing schisms.

Argentina, Bolivia, Colombia and Peru seem most likely to reach out for foreign support. But we forecast that China and the US will try to draw as many Latin American countries as possible into their sphere of influence. They are likely to do this mainly by providing material aid, loans or promoting private investments. While this will help these governments limit the potential for large protests and social unrest, we anticipate it will come with pressure for the recipient government to support their backer’s foreign policy objectives.

The need to pick sides between China and the US will almost certainly further polarise the region. For those seeking Chinese backing, a severing of diplomatic ties with Taiwan is likely to be the main demand. Meanwhile the US will probably use its clout to strengthen a regional coalition of countries pushing for regime change in Venezuela.

We forecast that several countries in the region, particularly Brazil and Colombia, will join the US

in pushing for a peaceful transition to democracy in Venezuela. Their main tactic will probably be a broadening of sanctions, while offering a much-needed economic rescue plan in exchange for President Maduro’s resignation. We anticipate

that they will succeed towards the end of the year

in persuading at least some senior members of the Venezuelan government to drop their support

for Maduro and commit to fair or free elections

in 2022.

Competition for influence in Bolivia is also likely to preoccupy China and the US in 2021. We see this being positive for security and stability in Bolivia. The government there is likely to continue its cautious stance towards the US. This is particularly as the governing MAS party claims the US helped to force former president Evo Morales from office in late 2019. But Bolivia is in a strong position to balance relations with China and the US. The economic benefits of this will help the country avoid a resurgence of large anti-government protests.

Foreign economic aid is likely to help the government in Argentina avoid facing destabilising protests and strikes. Though anti-government demonstrations in major cities will almost

certainly remain common next year. President Alberto Fernandez’s efforts to pass judicial reforms are a probable trigger for protests. But the government will probably be able to assemble sufficient aid to avoid unpopular cuts to welfare, wages and subsidies. And this will safeguard his strong bond with the country’s main trade unions and ensure that any protests do not cause government instability.

Operational risks to businesses in Brazil will probably include having to often adapt to changing government policies in 2021. President Jair Bolsonaro’s often erratic approach to foreign relations means that he is likely to struggle to balance relations with China and the US. Brazil and China have long had close economic ties, while Mr Bolsonaro is ideologically more drawn to the US. But plans by the Biden administration to push for environmental protection of the Amazon rainforest means that Mr Bolsonaro will probably seek to sustain and deepen economic relations with China.

An unstable security environment in Mexico means that the government will probably have to relent to US pressures on its counter-narcotics approach before being able to fully access its economic aid. The government is very likely to maintain close ties with the US, its main trading partner. But organised crime and persistently high gang-related violence mean that it is likely to give in to US calls for a more robust approach against organised crime groups.

The Biden administration is likely to make its assistance, at least partially, contingent on Mexico increasing the military’s role and accepting more US security assistance in its fight against organised crime groups. While this indicates that external influence will probably help to mitigate some risks, they are unlikely to resolve all operational risks in Mexico or the region at large. And this means that political instability is likely to persist across Latin America this year.

An unstable security environment in Mexico means that the government will probably have to relent to US pressures on its counter-narcotics approach before being able to fully access its economic aid.

Image: Javier Torres/Getty Images

Image: Carolina Cabral/Getty Images

Click on a commodity to see more

Forecasts

Renewed tensions between congress and the presidency after a general election in April are likely to lead to institutional deadlock and protests by supporters of former president Vizcarra. Political parties that led the impeachment of Mr Vizcarra in November 2020 will probably fail to secure a majority in congress and win the presidency. Protests by supporters of Mr Vizcarra will gradually subside in the weeks after the poll, but short bouts of disruptive protests remain likely in 2021.

Political paralysis in Peru

The ELN will probably relent to government pressure and fulfil all preconditions for peace talks towards the end of 2021. But these will probably drag on for a few years, based on previous negotiations with the FARC. Factions within the ELN will probably resist the process and mount frequent attacks against security forces.

Peace talks in Colombia

Under US pressure, the Mexican government will probably continue its military-led approach against organised crime groups, with frequent military operations against gangs in the most affected states near the US border. A state of emergency declaration in these areas and increased security operations are likely to cause significant disruption to businesses operations.

Counter-insurgency in Mexico

Outliers

Morales returns to cabinet in Bolivia

Monitoring Points

China supporting Maduro

Covid-19 response

Greater Chinese financial support for Venezuela will be an indicator for greater resilience and stability of President Maduro’s regime in the face of regional efforts to unseat him. The most likely route for China to support Mr Maduro is through investments by Chinese firms into the country’s oil infrastructure or joint ventures with local companies.

Brazil-US relations

The effectiveness of regional intergovernmental organisations this year will greatly depend on relations between the presidents of Brazil and the US. Mr Bolsonaro and Mr Biden are very likely to clash over environmental protection in the region, which will probably block regional cooperation on other issues as well. Two scheduled meetings of the Organisation of American States (OAS) are likely flashpoints for spats; the General Assembly in Guatemala, probably in June 2021, and the Summits of the Americas in the US, probably around mid-to-late 2021.

The responses of regional governments to domestic Covid-19 outbreaks will be determined by the availability and potency of vaccines. Most countries in Latin America will probably gain access to vaccines soon after they are officially approved and mainly through Covax, a global mechanism to ensure low-income countries have access to Covid-19 vaccines. A serum by US company Pfizer will probably be the first to be rolled out in Q1. But full inoculation will depend on the completion and roll-out of other vaccines by Chinese, Russian and UK firms later in the year.

Images: Javier Mamani; Luis Acosta; Alexis Delelisi; Pool; Nelson Almeida; Carlos Mamani/Getty Images