CONSISTENT

WORSENING

IMPROVING

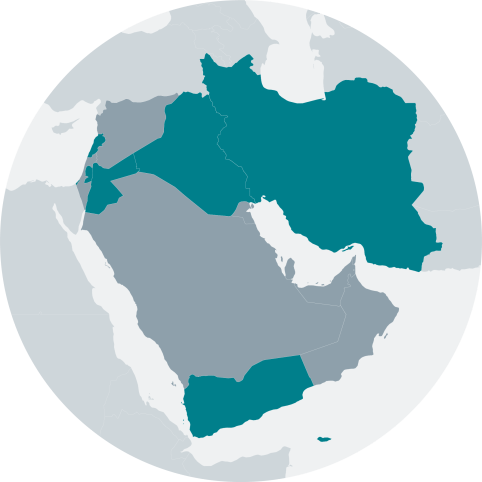

Overall trend: Consistent

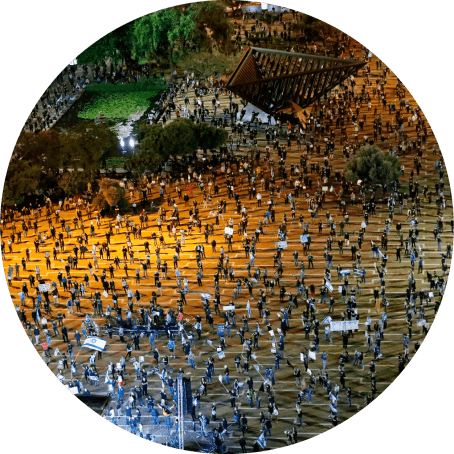

Image: Dan Kitwood/Getty Images

in substantive improvements to the operating environment this year. In the meantime, the region faces a range of challenges that threaten to derail the positive strategic momentum. These include a new president in Iran, militia violence in Iraq, and rising insecurity

in Lebanon.

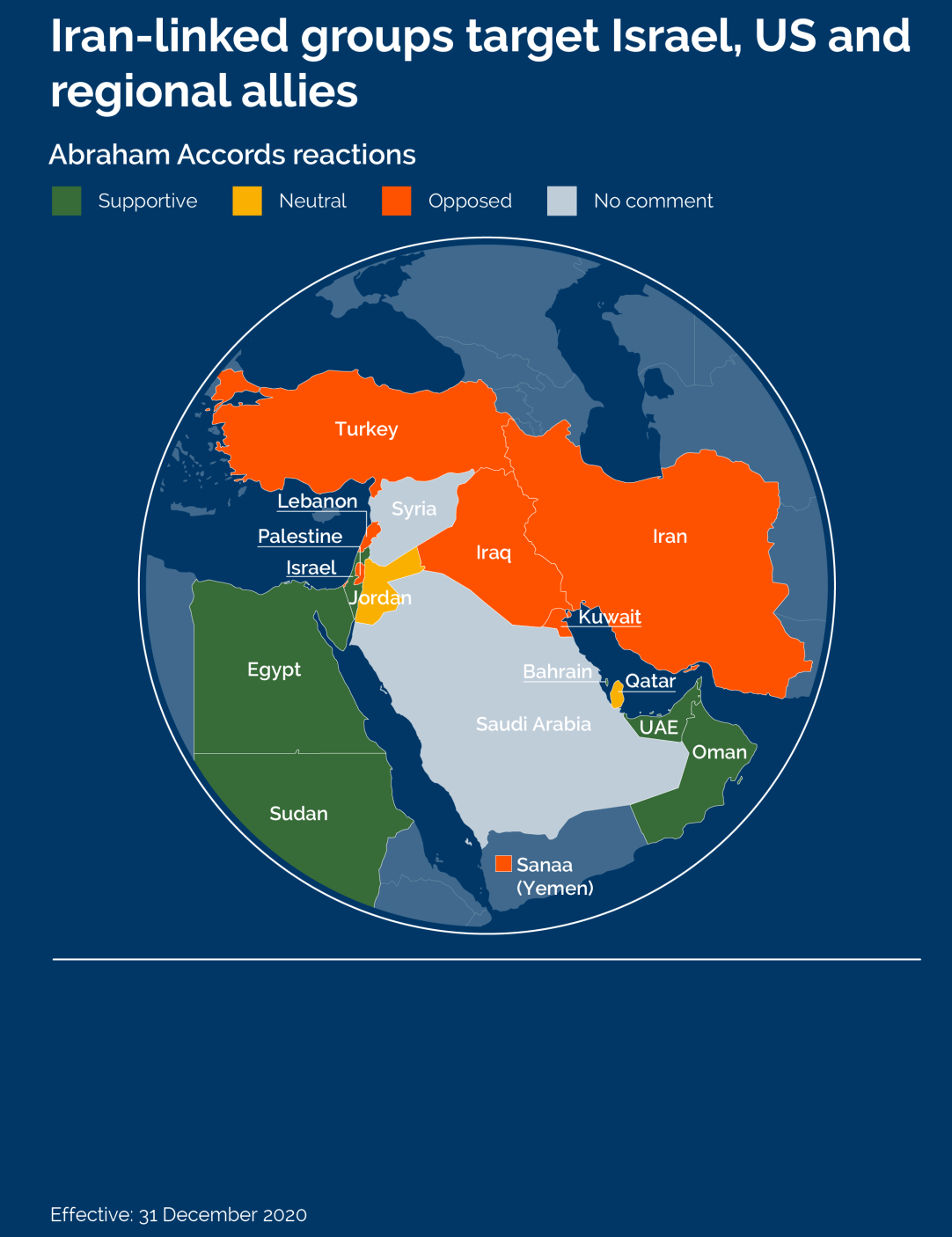

Relations between Israel and Arab states are likely to improve this year. We anticipate more states, including Saudi Arabia, will spend 2021 weighing the benefits of joining the UAE, Bahrain, Sudan and Morocco in normalising relations with Israel. The signing of the Abraham Accords upended more than 50 years of a unified Arab stance. Initially, this will most likely open new trade opportunities and flight routes, rather than close coordination with Israel on security.

Saudi Arabia probably views relations with Israel as strategically advantageous in the long term. The US is likely to perceive favourably Arab states that enter a partnership with its foremost ally in the Middle East. Saudi Arabia and most other Gulf states probably view progress towards relations with Israel as a means to engage positively with the incoming US administration in 2021. Kuwait is an exception, and we forecast that its parliament will be a vocal but ineffective critic of its neighbours.

We doubt that moves to normalise relations with Israel will lead to much public opposition in the Gulf or much of the rest of the region. Although one reason Saudi Arabia will probably move slowly

and hold back from signing a deal in 2021 is caution about managing the potential domestic

and regional response. If it were to normalise ties with Israel without addressing the Palestinian issue, it would damage its standing and raise the potential for some public backlash domestically, albeit limited.

Most regional states have set securing progress towards Palestinian statehood as the price for normalising ties with Israel. It has rarely been a priority for governments in the region in recent years, unless it serves a wider strategic purpose. We do not anticipate them making many advances on Palestinian statehood in 2021. Oman, Qatar and Saudi Arabia are likely to try to facilitate Israeli-Palestinian talks this year, but any peace process will probably take several years to get anywhere near a final status agreement.

Any early attempts to pursue peace between the Israelis and the Palestinians are very likely to be met with opposition from Iran. But we forecast that this will primarily be through rhetoric rather than an escalation in violent approaches. The Iranian state uses anti-Israeli sentiment, coupled with a presumed religious obligation in relation to the Palestinian cause, as a source of legitimacy domestically. So we suspect it will be reluctant to risk derailing any progress that Palestine is making in gaining concessions from Israel.

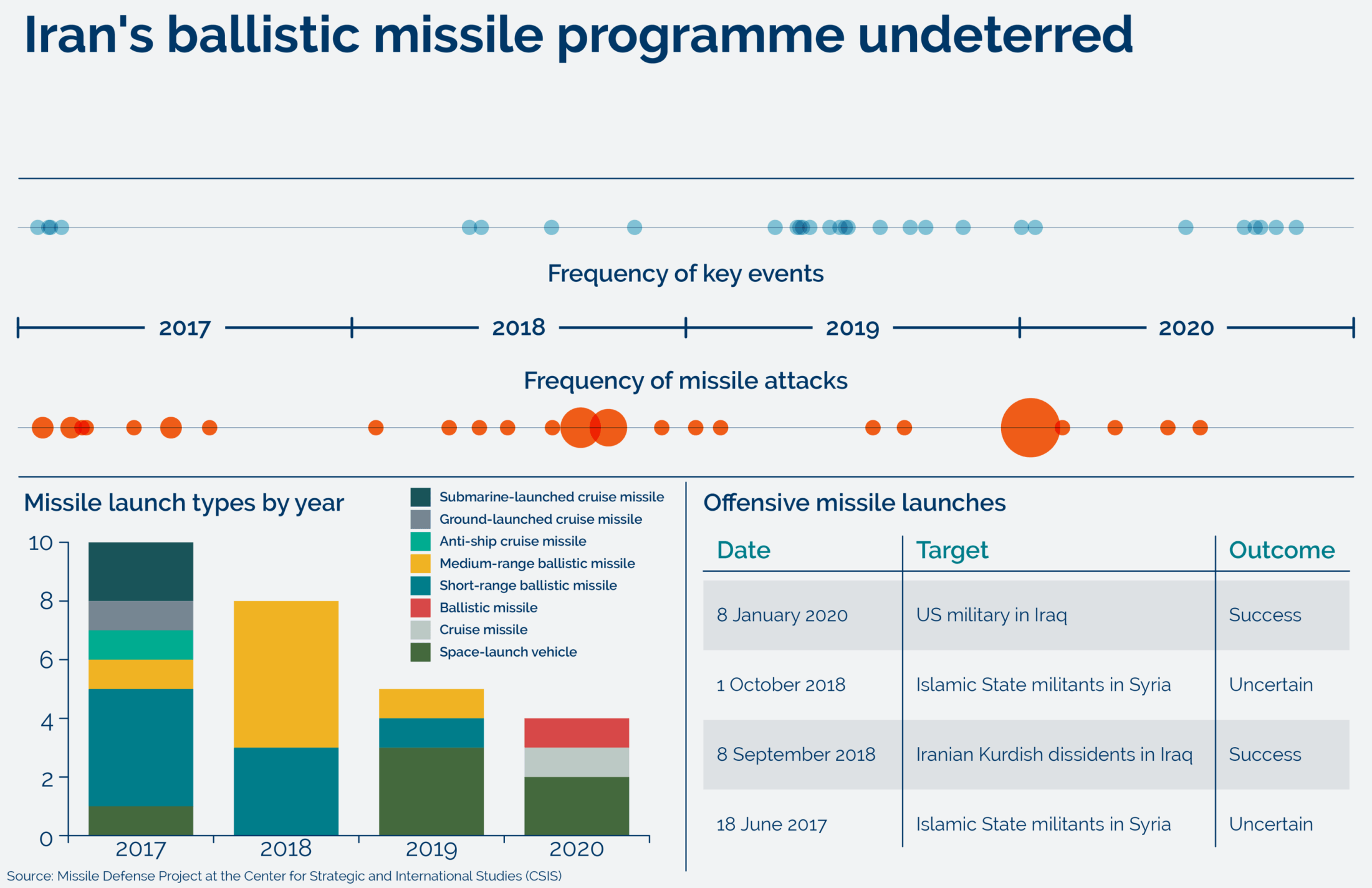

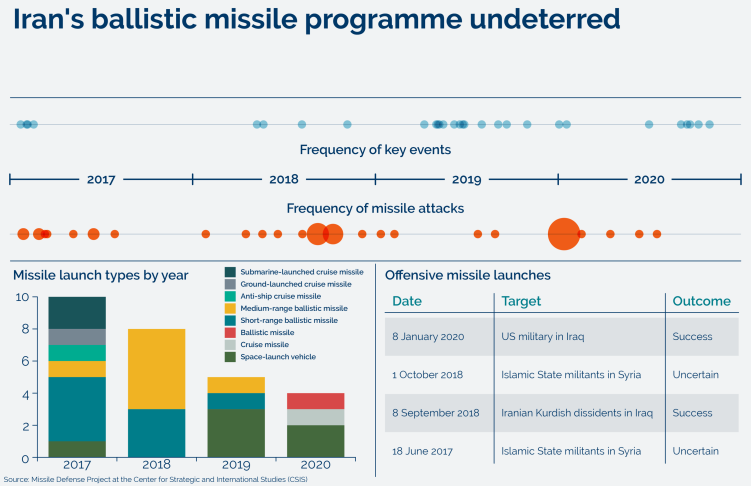

Iran will still need to show it is acting against Israel, however, in part to bolster its faltering domestic and regional support. It has for decades developed and led a so-called ‘axis of resistance’ aimed at opposing Israel among others. This includes Hezbollah, the Assad government in Syria, militias in Iraq and Yemen and militant activists in Bahrain. We assess it is very unlikely to deviate from this strategy and, while maintaining a veneer of deniability, will continue to proliferate arms and proxies in the region and use surprise attacks to test the resolve and evolving relations of Israel, the US and the Gulf states.

Domestically, Iran’s regime is likely to face rising criticism and we anticipate a bout of violent unrest over hardship in the first half of 2021. Already struggling with US sanctions, Covid-19 has further weakened the economy. There has been little in the way of public backlash over its handling of the pandemic. But we anticipate this changing in the coming months, at least based on patterns of unrest in recent years and the combination of the high death toll from Covid-19 and the persistent negative economic outlook.

One opportunity for Iran to improve its economic situation is a return to the nuclear deal. President-elect Biden is keen to return to the deal, but he will need to move quickly to do so. This is because President Rouhani, for whom the accord was

meant to be a legacy, must leave office in the summer after two terms. A presidential election

in Iran in June is likely to produce a hardline government – the hardline camp won a large parliamentary majority in 2020 and has been openly critical of the nuclear deal.

Despite Mr Biden and Mr Rouhani’s willingness to revive the nuclear deal, Iran is highly likely to seek compensation for the damage done to it by the Trump administration. This will delay progress in talks, and so on balance we do not anticipate them to succeed in reaching an agreement before Rouhani’s term ends. A hardline government in the second half of the year will probably be less accommodating towards Western attempts at engagement. This is not just over the nuclear deal, but also its ballistic missile programme and support for armed groups in the region.

Iran-aligned militias will probably resume their attacks on US interests in Iraq early this year as they aim to force all US troops from the country. While the US reduced troop numbers in Iraq in 2020, the Iraqi government remains wary of the threat posed by the remnants of Islamic State and so is unlikely to push for a full withdrawal. An intensification of attacks by militias on US

interests will probably push up the risk of an intra-Shia civil war this year. Although this is still an outlier scenario.

Amid these broader geopolitical dynamics, we forecast that the worsening security environment in Lebanon will go largely overlooked and unaddressed by regional powers. The cost of food and basic goods will probably continue to rise. Politicians have struggled to form a government, with many blaming Hezbollah and its intransigence on ministerial positions. Even if they implement the economic reforms that are needed to release international financial aid, it will probably come too late for most.

Worsening living conditions and political fractionalisation will probably prompt another bout of widespread protests in Lebanon in the spring. Such divisiveness will also make armed skirmishes between political and sectarian factions more likely. While we doubt this will evolve into a civil war, a failure by the government to secure financial aid would make such an outcome more likely. State authority is weakening, the operating environment is becoming more challenging and there are few in the region willing to rescue the political elite, or the country itself.

One opportunity for Iran to improve its economic situation is a return to the nuclear deal. President-elect Biden is keen to return to the deal, but he will need to move quickly to do so.

Despite Biden and Rouhani’s willingness to revive the nuclear deal, Iran is highly likely to seek compensation for the damage done to it by the Trump administration.

Image: Saul Loeb/Getty Images

Image: Anwar Amroi/Getty Images

Forecasts

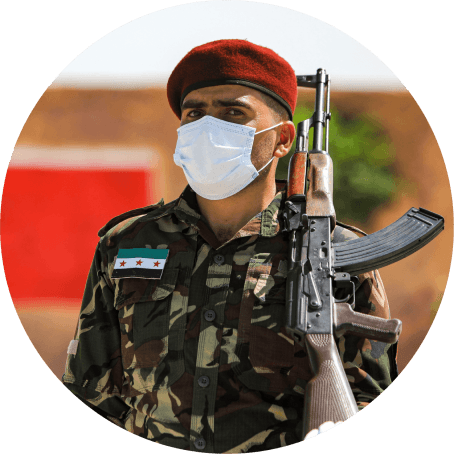

Militia violence in Iraq is highly likely to intensify in frequency and expand in targeting in 2021. The US will probably be reluctant to fully withdraw troops from Iraq, which will prompt militias to seek other means of applying pressure on the US. A broadening of targeting by militias would be likely to include the oil and gas sites operated by companies they perceive as linked to the US. This will probably also push up the risk of kidnap for foreigners in Baghdad and southern Iraq.

Iraqi militias push for US withdrawal

We forecast that there will be a new president of the Palestinian Authority in 2021. Mahmoud Abbas’ position has been looking increasingly untenable in recent years due to concerns over his health, as well as low popularity among Palestinians. Consequently, President Abbas will most likely lose a presidential election if he chooses to run and if Palestinian factions manage to hold a vote. If they do not, we anticipate that he will face pressure to resign, particularly from Saudi Arabia and the UAE.

Change in Palestinian Authority leadership

We forecast sharp increases in spending on military hardware this year. This will probably contribute to tensions among major powers, but we do not think it will lead to a heightened risk of a regional conflict in 2021. The expiry of a UN arms embargo on Iran in 2020 means that Russia and China can now sell weapons to Tehran. Gulf states are likely to appeal to the US to react in kind. Israel will most likely join these appeals with the caveat that the US ensures its military edge in the region.

Regional arms race

Forecasts

Outliers

Saudi Arabia palace coup

Monitoring Points

Reform efforts in Lebanon

The passage of much needed economic reforms in Lebanon will be an indicator for political and security stability in the country going into 2021. The release of financial aid would bring stability to the government and lower the risk of factionalised armed violence that itself would have the potential to escalate into a civil war. Without reforms, public pressure on the government will rise, as will tensions between sectarian-political factions in the country.

Covid-19 restrictions and unrest

The Covid-19 pandemic seems highly likely to remain a global health emergency in 2021. Restrictions on movement in 2020 prompted protests in Israel. Prolonged and strict restrictions including the closure of businesses are likely to have a negative impact on livelihoods across the region. And the socio-economic impact on countries that are already struggling economically will push up the risk of violent unrest later in 2021. These include Iraq, Jordan, Lebanon and Palestine.

Syria-Turkey relations

The tone of interactions between the governments of Syria and Turkey will probably be an indicator for the direction of the final stages of the Syrian civil war. Syrian military pressure on Turkish-backed forces in the northwest would signal a probable broader military escalation there. Whereas diplomatic engagement would probably involve Turkey demanding Syria to exert control over Kurdish militants in the northeast.

Images: Fayez Nureldine; AFP; Impossible Moment; Joseph Eid; Bakr Alkasem; Jack Guez/Getty Images

Overall trend: Consistent

CONSISTENT

WORSENING

IMPROVING

Image: Dan Kitwood/Getty Images

in substantive improvements to the operating environment this year. In the meantime, the region faces a range of challenges that threaten to derail the positive strategic momentum. These include a new president in Iran, militia violence in Iraq, and rising insecurity

in Lebanon.

Relations between Israel and Arab states are likely to improve this year. We anticipate more states, including Saudi Arabia, will spend 2021 weighing the benefits of joining the UAE, Bahrain, Sudan and Morocco in normalising relations with Israel. The signing of the Abraham Accords upended more than 50 years of a unified Arab stance. Initially, this will most likely open new trade opportunities and flight routes, rather than close coordination with Israel

on security.

Saudi Arabia probably views relations with Israel as strategically advantageous in the long term. The US is likely to perceive favourably Arab states that enter a partnership with its foremost ally in the Middle East. Saudi Arabia and most other Gulf states probably view progress towards relations with Israel as a means to engage positively with the incoming US administration in 2021. Kuwait is an exception, and we forecast that its parliament will be a vocal but ineffective critic of its neighbours.

We doubt that moves to normalise relations with Israel will lead to much public opposition in the Gulf or much of the rest of the region. Although one reason Saudi Arabia will probably move slowly

and hold back from signing a deal in 2021 is caution about managing the potential domestic

and regional response. If it were to normalise ties with Israel without addressing the Palestinian issue, it would damage its standing and raise the

potential for some public backlash domestically, albeit limited.

Most regional states have set securing progress towards Palestinian statehood as the price for normalising ties with Israel. It has rarely been a priority for governments in the region in recent years, unless it serves a wider strategic purpose. We do not anticipate them making many advances on Palestinian statehood in 2021. Oman, Qatar and Saudi Arabia are likely to try to facilitate Israeli-Palestinian talks this year, but any peace process will probably take several years to get anywhere near a final status agreement.

Any early attempts to pursue peace between the Israelis and the Palestinians are very likely to be met with opposition from Iran. But we forecast that this will primarily be through rhetoric rather than an escalation in violent approaches. The Iranian state uses anti-Israeli sentiment, coupled with a presumed religious obligation in relation to the Palestinian cause, as a source of legitimacy domestically. So we suspect it will be reluctant to risk derailing any progress that Palestine is making in gaining concessions from Israel.

Iran will still need to show it is acting against Israel, however, in part to bolster its faltering domestic and regional support. It has for decades developed and led a so-called ‘axis of resistance’ aimed at opposing Israel among others. This includes Hezbollah, the Assad government in Syria, militias in Iraq and Yemen and militant activists in Bahrain. We assess it is very unlikely to deviate from this strategy and, while maintaining a veneer of deniability, will continue to proliferate arms and proxies in the region and use surprise attacks to test the resolve and evolving relations of Israel, the US and the

Gulf states.

Domestically, Iran’s regime is likely to face rising criticism and we anticipate a bout of violent unrest over hardship in the first half of 2021. Already struggling with US sanctions, Covid-19 has further weakened the economy. There has been little in the way of public backlash over its handling of the pandemic. But we anticipate this changing in the coming months, at least based on patterns of unrest in recent years and the combination of the high death toll from Covid-19 and the persistent negative economic outlook.

One opportunity for Iran to improve its economic situation is a return to the nuclear deal. President-elect Biden is keen to return to the deal, but he will need to move quickly to do so. This is because President Rouhani, for whom the accord was

meant to be a legacy, must leave office in the summer after two terms. A presidential election

in Iran in June is likely to produce a hardline government – the hardline camp won a large parliamentary majority in 2020 and has been openly critical of the nuclear deal.

Image: Saul Loeb/Getty Images

One opportunity for Iran to improve its economic situation is a return to the nuclear deal. President-elect Biden is keen to return to the deal, but he will need to move quickly to do so.

Image: Anwar Amroi/Getty Images

Forecasts

We forecast sharp increases in spending on military hardware this year. This will probably contribute to tensions among major powers, but we do not think it will lead to a heightened risk of a regional conflict in 2021. The expiry of a UN arms embargo on Iran in 2020 means that Russia and China can now sell weapons to Tehran. Gulf states are likely to appeal to the US to react in kind. Israel will most likely join these appeals with the caveat that the US ensures its military edge in the region.

Regional arms race

Militia violence in Iraq is highly likely to intensify in frequency and expand in targeting in 2021. The US will probably be reluctant to fully withdraw troops from Iraq, which will prompt militias to seek other means of applying pressure on the US. A broadening of targeting by militias would be likely to include the oil and gas sites operated by companies they perceive as linked to the US. This will probably also push up the risk of kidnap for foreigners in Baghdad and southern Iraq.

Iraqi militias push for US withdrawal

We forecast that there will be a new president of the Palestinian Authority in 2021. Mahmoud Abbas’ position has been looking increasingly untenable in recent years due to concerns over his health, as well as low popularity among Palestinians. Consequently, President Abbas will most likely lose a presidential election if he chooses to run and if Palestinian factions manage to hold a vote. If they do not, we anticipate that he will face pressure to resign, particularly from Saudi Arabia and the UAE.

Change in Palestinian Authority leadership

Outliers

Saudi Arabia palace coup

Monitoring Points

Reform efforts in Lebanon

Covid-19 restrictions and unrest

The passage of much needed economic reforms in Lebanon will be an indicator for political and security stability in the country going into 2021. The release of financial aid would bring stability to the government and lower the risk of factionalised armed violence that itself would have the potential to escalate into a civil war. Without reforms, public pressure on the government will rise, as will tensions between sectarian-political factions in the country.

Syria-Turkey relations

The tone of interactions between the governments of Syria and Turkey will probably be an indicator for the direction of the final stages of the Syrian civil war. Syrian military pressure on Turkish-backed forces in the northwest would signal a probable broader military escalation there. Whereas diplomatic engagement would probably involve Turkey demanding Syria to exert control over Kurdish militants in the northeast.

The Covid-19 pandemic seems highly likely to remain a global health emergency in 2021. Restrictions on movement in 2020 prompted protests in Israel. Prolonged and strict restrictions including the closure of businesses are likely to have a negative impact on livelihoods across the region. And the socio-economic impact on countries that are already struggling economically will push up the risk of violent unrest later in 2021. These include Iraq, Jordan, Lebanon and Palestine.

Images: Fayez Nureldine; AFP; Impossible Moment; Joseph Eid; Bakr Alkasem; Jack Guez/Getty Images