High-Risk Maritime Zones

Sources: Lloyd's List, Trafigura, BRS

Coastal countries along Russian oil shipping routes are most at risk of incidents linked to Russia’s shadow fleet. This includes Norway, Denmark, Finland, the UK and Sweden, but also busy maritime routes, such as Kattegat, Gibraltar and the English Channel. In a report from last year, Greenpeace warned that 171 shadow fleet tankers in the previous two years had passed through the Fehmarn Belt (leading to Kattegat), which exposes Germany’s Baltic coast to the risks of oil spills and traffic disruption.

According to Lloyd's List, there are multiple hotspots for the ship-to-ship transfer of Russian oil in European waters, including the coasts of Gotland (Sweden), the Laconian Gulf, Lesbos and Chios (Greece), Romania and around Malta. In case of an oil spill (such as during the ship-to-ship transfer), it is very likely that the responsibility for any clean-up would fall on the coastal country. The Kyiv School of Economics estimates the clean-up cost from a single tanker spill at between $859 million and $1.6 billion.

The Russian shadow fleet is almost certain to grow in size and pose a risk to maritime traffic in Europe in 2025. This includes on the Baltic, North and Mediterranean seas. Since the invasion of Ukraine and subsequent Western energy sanctions, Russia has been circumventing these by use of this fleet.

According to shipbroker BRS, this fleet now comprises 8.5% of all oil tankers globally, growing from 200 to about 790 ships in the last three years. Shadow fleet activity poses several risks to maritime routes, ports and coastal states. These include disruptions to sea traffic, damage to critical infrastructure, and espionage (with ships used for intelligence gathering, for example).

Russia is reliant on a growing shadow fleet to circumvent energy sanctions, raising risks associated with its use

These risks include oil spillages, ship abandonment, disruption of maritime routes, espionage and damage to critical infrastructure

Coastal countries along Russian oil shipping routes – such as Norway, Denmark, Finland, Sweden, the UK and Greece – are at the highest risk from the effects of an accident related to the shadow fleet in 2025

28 February 2025:

Eagle S held in custody, with the crew facing charges of aggravated vandalism and interference with telecommunications

2140hrs:

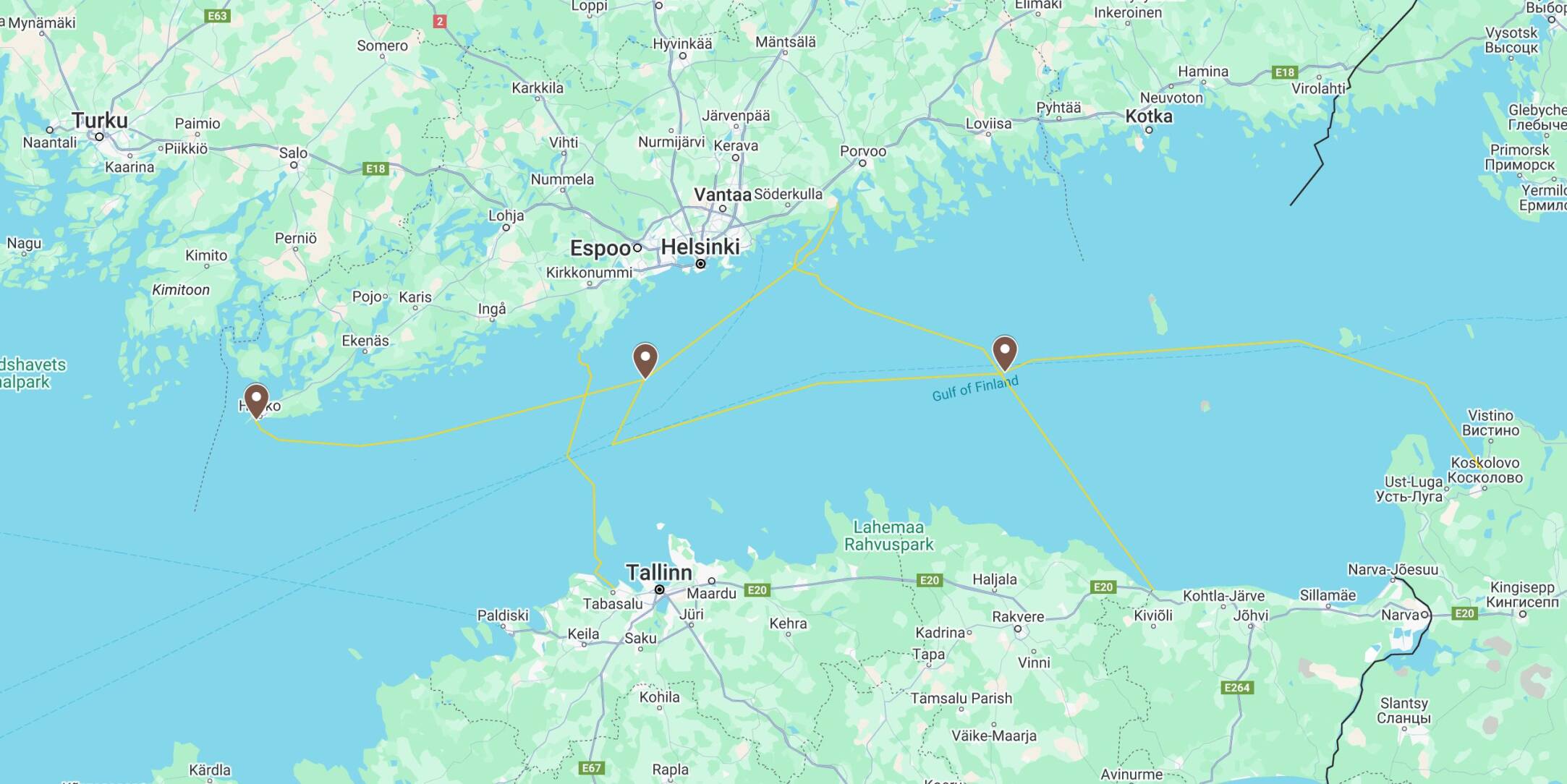

Turva met with the Eagle S 20km from Porkkala and escorted it the following day to an anchorage point in Sköldvik bay

Around 1830 hrs, the Finnish Coast Guard vessel Turva ordered Eagle S to enter Finnish territorial waters

Within the next 6 hours, Eagle S damaged five more telecom cables with the anchor, heading towards Estlink-1

25 December 2024, 1226hrs:

Energy operator reports a power outage as Eagle S dropped the anchor and dragged it over Estlink-2 energy interconnector

The Russian shadow fleet poses a threat to countries through the sabotage of communications and energy infrastructure, as well as espionage, with vessels used for intelligence gathering and monitoring of naval movements, for example. Incidents of damage to subsea infrastructure are designed to appear random, but seem to be part of Moscow’s hybrid warfare campaign in Europe more broadly.

In the last four years, we have noted eight cases of damage to subsea cables in the North and Baltic seas. For instance, last December, the Eagle S tanker not only damaged subsea infrastructure in the Gulf of Finland, but also had espionage equipment onboard, according to Finnish authorities.

Damage to subsea infrastructure can affect regional internet access and energy supplies. The energy connector damaged last year in the Gulf of Finland by the Eagle S tanker will take several months to repair, undermining Finland’s energy security. And more than 200 Russian vessels have been spotted loitering over critical subsea infrastructure across the North Sea since 2014, according to investigative journalists.

Some of these incidents were associated with Russian ‘fishing’ and cargo vessels. Such incidents are likely to continue in 2025, given that neither the US nor the EU appear likely to ease their economic sanctions on Russia soon.

The vessel drifted for six hours before it dropped anchor for repairs, blocking traffic in the strait

11 March 2023:

Canis Power lost power near the Danish island of Langeland, situated in the Great Belt Strait.

The second category of risk is the accidents that these ships can cause. On average, tankers in the shadow fleet are over 15 years old, while 20 years is the typical lifespan of an oil carrier. This results in maintenance problems, such as engine failures, which can lead to collisions or loss of manoeuvrability.

For instance, in May 2023 an 18-year-old shadow fleet tanker, Canis Power, carrying 340,000 barrels of Russian oil lost engine power while passing through the Danish Straits and nearly ran aground.

Sanctioned shadow fleet vessels often lack adequate insurance, exposing nearby ships, port operators and coastal states to financial risk. Tracking small and opaque insurers and claiming damages can be futile, leaving coastal countries or ports to bear the full cost of spill clean-up, wreck removal, damage repair or scrapping. In January this year an 18-year-old Eventin tanker with 99,000 tonnes of Russian oil had to be towed away by the German authorities due to engine failure. Germany seized the vessel and its cargo in March, after it was sanctioned in late February

14 March 2025:

The Eventin and its cargo are confiscated by Germany’s General Customs Directorate for being part of Russia’s shadow fleet

24 February 2025:

The EU adds the Eventin to the list of sanctioned tankers

12 January 2025, 0625hrs:

The Eventin arrives at the anchorage point, where it has stayed until today, held steady by commercial tugboats

11 January 2025, 0150hrs:

The tugboats move the Eventin to an anchorage spot just east of the port of Sassnitz

2338hrs:

Additional tugs, VB Luca and VB Bremen, also attached lines to the Eventin, holding it in place

1532hrs:

The Bremen Fighter successfully attached a tow line to the Eventin tanker

1357hrs:

Germany’s maritime rescue sent two tugboats, the Bremen Fighter and VB Luca, to help the stranded tanker. Another tugboat, the Baltic, and a rescue ship called Arkona were also on their way from the port of Rostock

10 January 2025, 1230hrs: Eventin tanker sailing from Ust-Luga on the Gulf of Finland to Port Said in Egypt suddenly lost engine power and drifted off the coast of Germany, near Cape Arkona, amid high winds

Shadow fleet tankers also pose a risk to maritime traffic due to poor crew skills and potential ship abandonment. This again creates financial risks and the increased risk of accidents. As these tankers do not have proper insurance, they do not have to adhere to Western business standards for crew qualifications, often resulting in a lack of seamanship.

The Swedish authorities designated this as a potential cause of damage to a subsea cable near Gotland in January this year. One in five shadow vessels refuse pilotage through the treacherous waters of the Danish straits, risking an incident and major traffic disruption on a key maritime route.

In addition, coastal countries or hosting ports must cover any costs related to abandoned ships. This was the case with the Russian tanker Vladimir Latyshev, which has been stuck in the port of Saint-Malo for the past three years due to sanctions. The local port authorities still have to maintain its crew and reposition it daily due to the vessel’s size.

May 2025:

The seven-man crew is still stuck aboard and has to frequently reposition the vessel across the port

1 March 2022:

The ship is apprehended by Saint-Malo Customs, following its addition to the sanctions list a day before

28 February 2022:

Vladimir Latyshev cargo ship arrives in Saint-Malo, delivering magnesia

17 December 2024:

State of emergency announced in the area due to spillage of heavy fuel oil, as the first oil washes ashore on nearby beaches

15 December 2024, 1020hrs: Volgoneft-239 sends an SOS signal and runs aground 80m from the shore

15 December 2024, 1000hrs: Volgoneft-212 sends an SOS signal

15 December 2024, 0840hrs:

Volgoneft-212 breaks in half during high winds

November-December 2024: Volgoneft-212 and Volgoneft-239, both river-class tankers, sailed towards an oil transfer spot outside the port of Kavkaz to meet the FIRN tanker

A further risk is of oil spills linked to ships engaged in sanctions evasion. Shadow fleet vessels are likely to be engaged in ship-to-ship transfers of oil. Unsuitable small river tankers or cargo ships are often used to pump oil to a bigger carrier on the open sea, so as to avoid sanctions and obscure the origin of the cargo.

Such operations, when conducted by an inexperienced crew or using an old ship, are likely to lead to oil spills. In December 2024, two river-class tankers sank in the Kerch Strait and spilled up to 5,000 tonnes of heavy oil across the Black Sea, reportedly on the way to an oil tranfser hotspot.

Source: Dragonfly monitoring

Images: Getty Images (JUSSI NUKARI / Contributor; MIKKEL BERG PEDERSEN / Contributor; STRINGER/AFP)

Basemaps: Esri, © OpenStreetMap contributors, TomTom, Garmin, FAO, NOAA, USGS

The shadow fleet is likely to continue causing maritime disruption due to the limited capabilities of the affected coastal states to react. In December 2024, the Baltic countries agreed on a ‘disrupt and deter’ approach to tackle shadow fleets and their incumbent risks. This includes demanding proof of insurance from all vessels associated with the shadow fleet and, in some cases, inspecting or banning them.

In mid-January, NATO launched the Baltic Sentry mission, to patrol and surveil the Baltic Sea to prevent further disruption to subsea infrastructure. And on 11 April, the Estonian navy detained and boarded an oil tanker heading to Russia for sailing without valid insurance. The vessel was released on 26 April after addressing 40 violations identified upon boarding.

But such measures are very likely to be restricted by international maritime law, which only allows states to detain shadow fleet tankers within their territorial waters (12nm). Vessels have a right to reject calls to enter these waters and be boarded even if they are within the country’s exclusive economic zone (200nm). This legal constraint will probably limit the effectiveness of Baltic efforts to intercept or deter shadow fleet operations in international waters.

Mitigation measures