Realpolitik and realignment

The overall regional trajectory is one of improvement and change, which in many ways stems from how governments are realigning their relationships amid a more unstable global order.

Dates to watch

Key indicators

Yemen war

Developments in the war in Yemen in 2022 will probably signal the broader direction of regional military tensions and conflict risks. Moves towards a negotiated ceasefire between the Houthis and Saudi Arabia would very likely be the result of progress in talks between Iran and Saudi Arabia, and would also reduce the risk of drone and missile attacks against the kingdom’s military and oil infrastructure. Conversely an intensification in the conflict would signal a failure of regional diplomacy, sustaining a high risk of a conflict involving Iran and Gulf states.

Iranian diplomacy

Iran’s diplomatic outreach in 2022 is likely to be an indicator of its longer-term priorities and strategy to sustain its influence in the region and beyond. This will probably prioritise its immediate neighbours in the Gulf for security purposes. Strengthening economic ties with countries in Asia will probably be to the detriment of European states, as well as international efforts to curtail Iran’s nuclear activity and ballistic missile programme. The success of talks around the JCPOA will also be a barometer for Israel’s appetite to directly confront Iran.

Lebanese elections

The results of parliamentary elections in Lebanon, due at the end of March, will likely be an indicator of the country’s longer term stability. A strong showing for traditional sectarian parties would signal a continuity of dysfunctional governance and token reform efforts. If new secular or cross-sectarian parties are able to chip away at the hegemony of the traditional parties then this would be a significant shift from the status-quo and towards better governance. The polls will also show if attempts in recent years by Gulf states and the US to diminish Hezbollah’s influence in Lebanese politics have succeeded.

CLICK ON FLAGS TO

SHOW INFORMATION

Forecasts

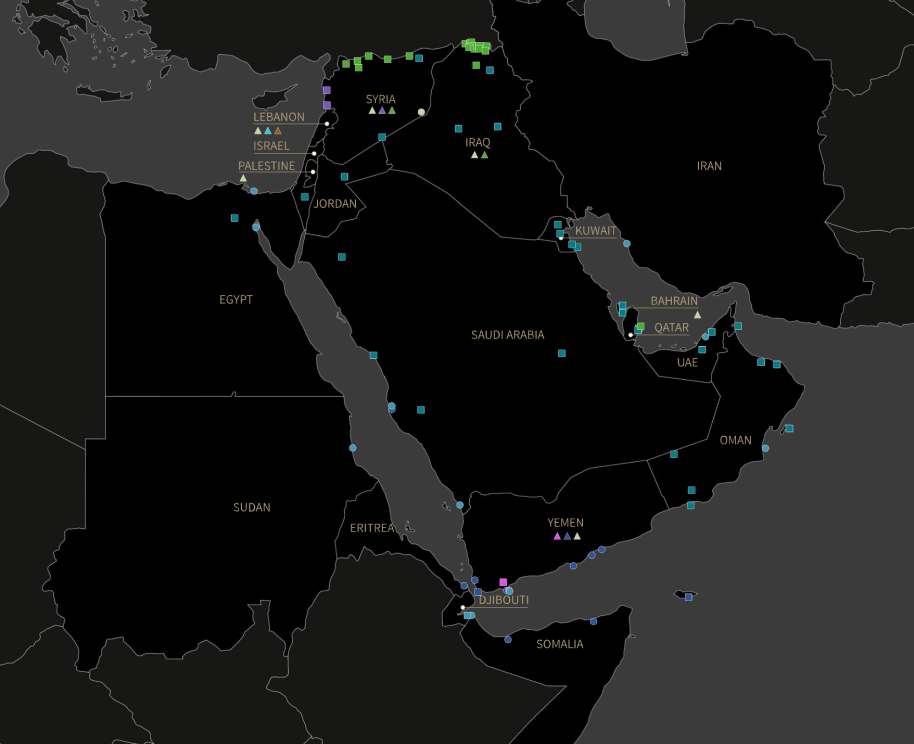

Regional and global powers jostle for influence in the Middle East, and their presence is particularly notable in crisis and conflict-prone countries; Iraq, Lebanon, Syria and Yemen. But the Gulf is a prized location too, and with the US retraction there comes greater opportunity for China, Russia and Turkey to gain footholds there.

KEY

Control of ports

Military bases or presence Proxies

China

Iran

Palestine

Russia

Saudi Arabia

Syria

Turkey

UAE

US

United States

UAE

All actors

China

Iran

Palestine

Russia

Saudi Arabia

Syria

Turkey

Foreign power and influence in the Middle East

Middle East

Iraq

Arbaeen pilgrimage

17 September

MIDDLE EAST

End of Ramadan

1 May

Middle East

Orthodox Christmas Eve

6 January

Bahrain

Anniversary of the 2011 anti-government protests

14 January

Iran

Anniversary of Ayatollah Khomeini's 1979 return to Iran

1 February

Iran

Islamic Revolution anniversary celebrated in Iranian calendar's 11th month

11 February

Middle East

Annunciation Day

25 March

Lebanon

Legislative elections

27 March

Middle East

Earth Day

22 April

Palestine

Land Day - Commemorating 1976 killings of protesters

30 March

Iran

Quds Day - Pro-Palestinian rallies held in cities globally

29 April

Middle East

Start of Ramadan

2 April

Saudi Arabia

Arab League Educational, Cultural, and Scientific Organization Summit

Before December

Middle East

Eid Al-Fitr

2 May–3 May

Palestine

Nakba day

15 May

Israel / Palestine

Anniversary of 2018 move of US Embassy to Jerusalem

17 May

Iran

Anniversary of Ayatollah Khomeini’s death

3 June

Egypt / Iraq / Israel / Jordan / Lebannon / Syria

Anniversary of the Six-Day War in 1967

5 June–10 June

Middle East

Eid Al-Adha

9 July

Lebanon

Anniversary of the 2020 Beirut Port explosion

4 August

Middle East

Ashura

7 August–8 August

Iraq

Anniversary of anti-goverment protests

October

Bahrain

Legistlative elections

November

Iraq

Anniversary of killings

of IRGC and Iraqi

militia commanders

3 January

Scroll down

Images: Getty Images (Ahmad Al-Rubaye/AFP; AFP; Anwar Amro)

But it does mean the overall regional trajectory is one of improvement and change, which in many ways stems from how governments are realigning their relationships amid a more unstable global order.

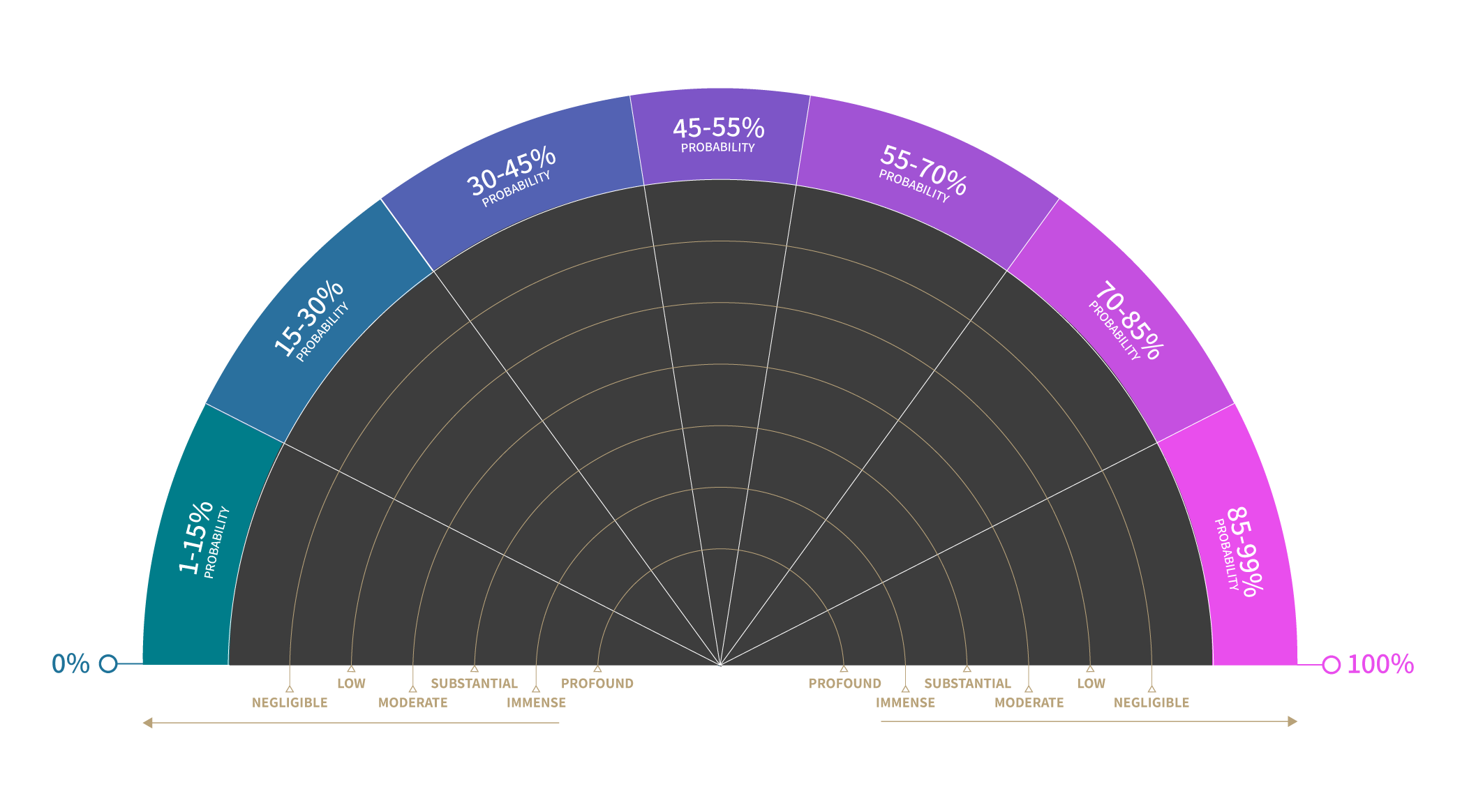

Our outlook for the Gulf for 2022 is one of stabilisation, with high-impact risks like interstate conflict on an improving trajectory. A regional conflict involving Iran – the prospect of which has cast a long shadow across the region in recent years – is no longer likely. Other high stakes disputes involving Qatar and Turkey have also eased. And we assess that there is a reasonable chance that in the coming year Saudi Arabia will be able to negotiate a substantive, long-term ceasefire deal with the Houthis in Yemen.

Realpolitik and

realignment

The Middle East has, perhaps paradoxically, one of the most positive outlooks of any region in 2022. This does not mean it will be free of insecurity or periodic crises, particularly not in Lebanon, Iran, Iraq and Syria, all of which will continue to feel the pernicious and cumulative effects of civil conflict and state decay.

We forecast that Iran and the US are likely to agree to a deal that at the very least brings some semblance of compliance with the JCPOA nuclear deal in the coming year. Talks about the US re-entering the deal have finally resumed, and there seems to be an emerging consensus in Washington, Jerusalem, Riyadh and Abu Dhabi to engage with, rather than confront, Tehran. This was evident from the lack of vocal Israeli opposition to talks, and progressive steps towards diplomatic re-engagement across the Gulf.

We are not anticipating a full detente, but rather that the previously severe level of interstate conflict risks fall to substantial in our risk ratings at most. Recent rivalries are also likely to further fade. Turkey, spurred on by both the cessation of the GCC blockade of its closest regional ally Qatar and its own economic decline, has begun to normalise ties with Gulf states. Regional relations retain an underlying volatility, but those events suggest that the Gulf leaders are taking more pragmatic and interest-driven approaches. >>

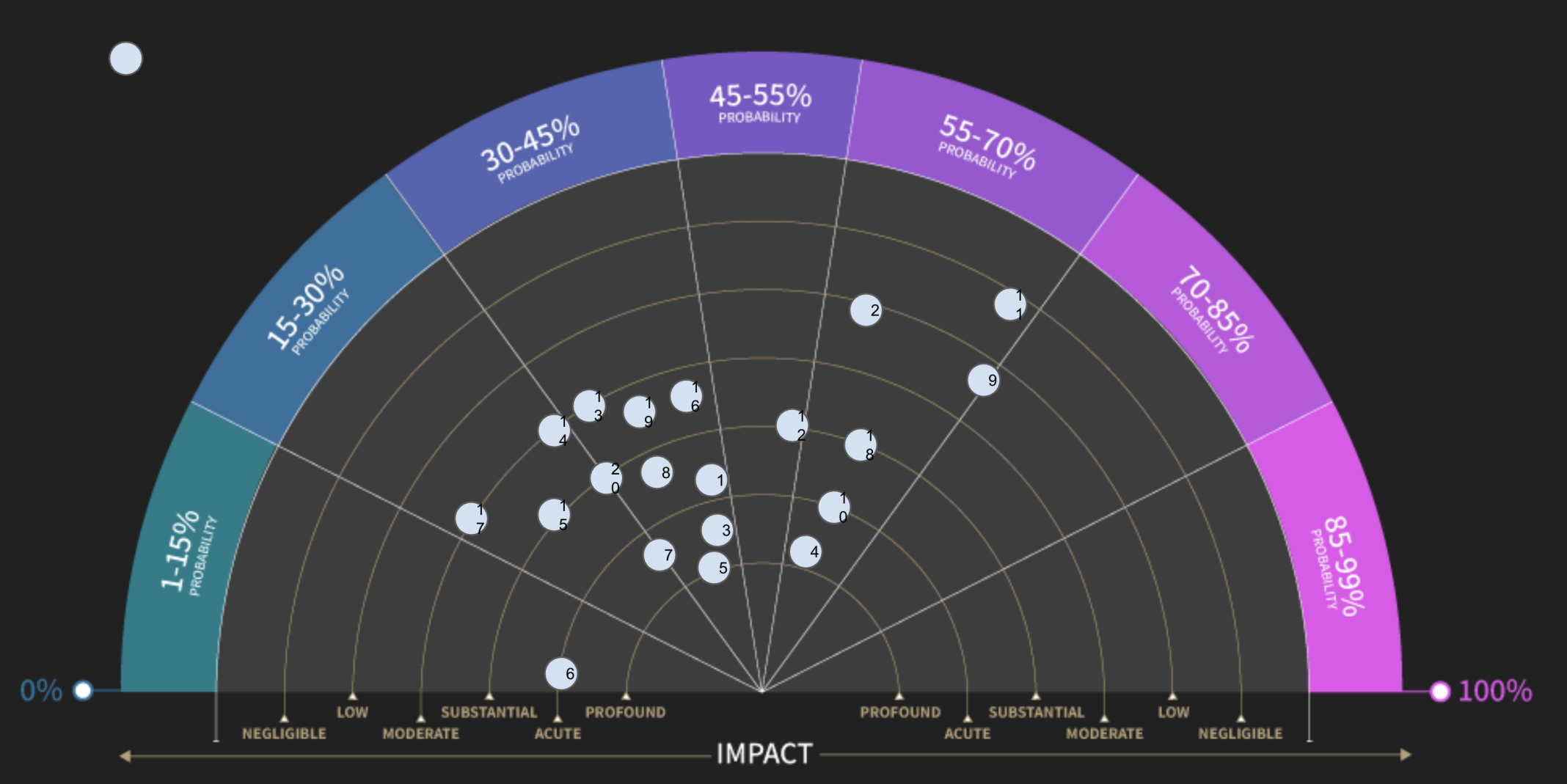

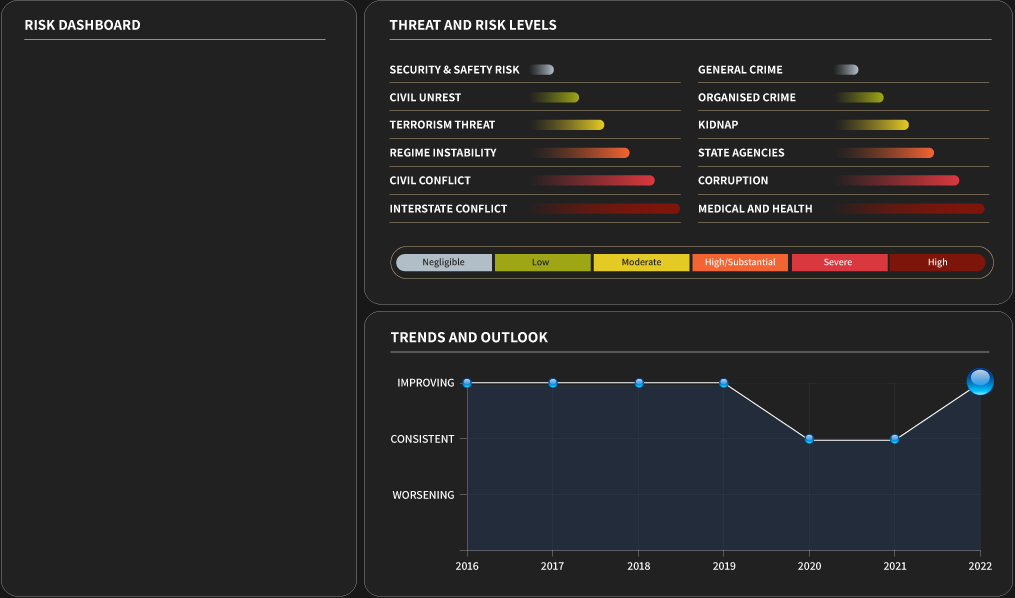

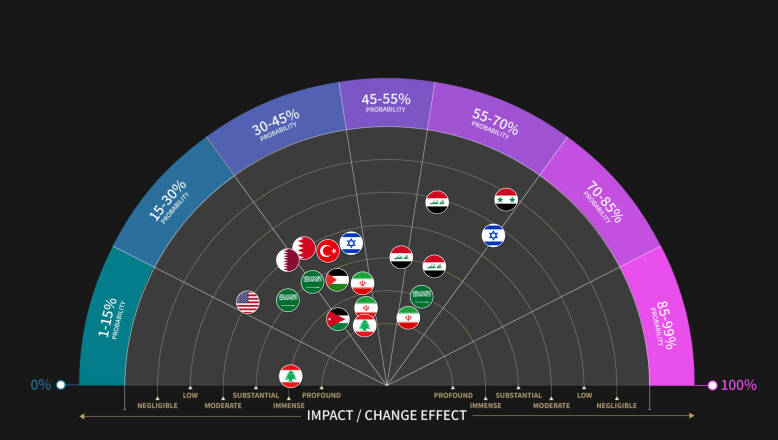

Risk dashboard

Infographic

Assessment

Forecasts

Dates to watch

Key indicators

Realpolitik and realignment

The overall regional trajectory is one of improvement and change, which in many ways stems from how governments are realigning their relationships amid a more unstable global order.

For best results

We recommend that you view this in a desktop browser. If using a tablet or smartphone, some infographics may only respond to device-specific gestures.

Forecasts

Key indicators

Yemen war

Developments in the war in Yemen in 2022 will probably signal the broader direction of regional military tensions and conflict risks. Moves towards a negotiated ceasefire between the Houthis and Saudi Arabia would very likely be the result of progress in talks between Iran and Saudi Arabia, and would also reduce the risk of drone and missile attacks against the kingdom’s military and oil infrastructure. Conversely an intensification in the conflict would signal a failure of regional diplomacy, sustaining a high risk of a conflict involving Iran and Gulf states.

Iranian diplomacy

Iran’s diplomatic outreach in 2022 is likely to be an indicator of its longer-term priorities and strategy to sustain its influence in the region and beyond. This will probably prioritise its immediate neighbours in the Gulf for security purposes. Strengthening economic ties with countries in Asia will probably be to the detriment of European states, as well as international efforts to curtail Iran’s nuclear activity and ballistic missile programme. The success of talks around the JCPOA will also be a barometer for Israel’s appetite to directly confront Iran.

Lebanese elections

The results of parliamentary elections in Lebanon, due at the end of March, will likely be an indicator of the country’s longer term stability. A strong showing for traditional sectarian parties would signal a continuity of dysfunctional governance and token reform efforts. If new secular or cross-sectarian parties are able to chip away at the hegemony of the traditional parties then this would be a significant shift from the status-quo and towards better governance. The polls will also show if attempts in recent years by Gulf states and the US to diminish Hezbollah’s influence in Lebanese politics have succeeded.

Saudi Arabia

Arab League Educational, Cultural, and Scientific Organization Summit

Before December

Middle East

Eid Al-Fitr

2 May–3 May

Middle East

Orthodox Christmas Eve

6 January

Bahrain

Anniversary of the 2011 anti-government protests

14 January

Iran

Anniversary of Ayatollah Khomeini's 1979 return to Iran

1 February

Iran

Islamic Revolution anniversary celebrated in Iranian calendar's 11th month

11 February

Middle East

Annunciation Day

25 March

Lebanon

Legislative elections

27 March

Middle East

Earth Day

22 April

Palestine

Land Day - Commemorating 1976 killings of protesters

30 March

Iran

Quds Day - Pro-Palestinian rallies held in cities globally

29 April

Middle East

Start of Ramadan

2 April

MIDDLE EAST

End of Ramadan

1 May

Palestine

Nakba day

15 May

Israel / Palestine

Anniversary of 2018 move of US Embassy to Jerusalem

17 May

Iran

Anniversary of Ayatollah Khomeini’s death

3 June

Egypt / Iraq / Israel / Jordan / Lebannon / Syria

Anniversary of the Six-Day War in 1967

5 June–10 June

Middle East

Eid Al-Adha

9 July

Lebanon

Anniversary of the 2020 Beirut Port explosion

4 August

Middle East

Ashura

7 August–8 August

Iraq

Arbaeen pilgrimage

17 September

Iraq

Anniversary of anti-goverment protests

October

Bahrain

Legistlative elections

November

Iraq

Anniversary of killings

of IRGC and Iraqi

militia commanders

3 January

Realpolitik and

realignment

The Middle East has, perhaps paradoxically, one of the most positive outlooks of any region in 2022. This does not mean it will be free of insecurity or periodic crises, particularly not in Lebanon, Iran, Iraq and Syria, all of which will continue to feel the pernicious and cumulative effects of civil conflict and state decay.

We forecast that Iran and the US are likely to agree to a deal that at the very least brings some semblance of compliance with the JCPOA nuclear deal in the coming year. Talks about the US re-entering the deal have finally resumed, and there seems to be an emerging consensus in Washington, Jerusalem, Riyadh and Abu Dhabi to engage with, rather than confront, Tehran. This was evident from the lack of vocal Israeli opposition to talks, and progressive steps towards diplomatic re-engagement across the Gulf.

We are not anticipating a full detente, but rather that the previously severe level of interstate conflict risks fall to substantial in our risk ratings at most. Recent rivalries are also likely to further fade. Turkey, spurred on by both the cessation of the GCC blockade of its closest regional ally Qatar and its own economic decline, has begun to normalise ties with Gulf states. Regional relations retain an underlying volatility, but those events suggest that the Gulf leaders are taking more pragmatic and interest-driven approaches. >>

But it does mean the overall regional trajectory is one of improvement and change, which in many ways stems from how governments are realigning their relationships amid a more unstable global order.

Our outlook for the Gulf for 2022 is one of stabilisation, with high-impact risks like interstate conflict on an improving trajectory. A regional conflict involving Iran – the prospect of which has cast a long shadow across the region in recent years – is no longer likely. Other high stakes disputes involving Qatar and Turkey have also eased. And we assess that there is a reasonable chance that in the coming year Saudi Arabia will be able to negotiate a substantive, long-term ceasefire deal with the Houthis in Yemen.

Images: Getty Images (Ahmad Al-Rubaye/AFP; AFP; Anwar Amro)

Foreign power and influence in the Middle East

Regional and global powers jostle for influence in the Middle East, and their presence is particularly notable in crisis and conflict-prone countries; Iraq, Lebanon, Syria and Yemen. But the Gulf is a prized location too, and with the US retraction there comes greater opportunity for China, Russia and Turkey to gain footholds there.